The two words ‘Financial Goals’ are fairly simple to understand.

It’s the ‘WHY’ of your investing(s) and saving(s). It’s the reason why you are ready to cut down your spendings today and put aside a part of your hard earned income for tomorrow. (Remember Save vs Spend debate?).

But… a lot of people invest without having a clear idea about what they are saving for.

They do have some idea about their major life goals but investments are mostly random. Or in many cases, driven by the need to save taxes (big mistake!).

But let me tell you one thing.

If you are aiming for beating the market or your friend’s portfolio returns, then you need to get a reality check. No doubt you will get emotional high and increased bank balance when you beat the market. But will that ‘beating’ be sufficient to help you achieve your goals?

Many people have no idea how to answer that question.

And this is one important reason why goal-based investing makes more sense for most people. I have already created a detailed guide on goal based investing. But I wanted to delve deeper into something that is at the core of goal-based investing.

You guessed it right, I am talking about…

GOALs

And more specifically…

Financial Goals

When it comes to planning your finances, one of the most critical things that you would be doing is identifying your financial goals.

This is ‘the’ first step.

If you have no specific goals that you are targeting, then you will be investing randomly in different financial products without knowing whether it is helping you get closer to your goals or not.

Its just like travelling without knowing your final destination or taking random paths. See below:

And this not advisable for most people.

But if you think that you are still ‘too young’ to bother about setting your goals or financial planning, then you are mistaken. Starting early on this path has eye-popping rewards. Don’t believe in the myth that goal setting is only for old people or for people in a certain age group or income bracket. It can be helpful for people at all stages of their lives. After all, everyone has financial dreams and needs.

So lets move on…

Life Goals –> Financial Goals

As humans, we are not born thinking about our financial goals.

Isn’t it?

As kids, we had various goals in life and we didn’t care what realities were and whether we were capable of achieving those goals or not. Its only when we grew up that reality sank in.

When I was a kid, I wanted to be an astronaut. That was the goal of life then. But as you might have guessed, that didn’t work out :-). And for me, it was like coming to terms with the reality that in life, we can have anything but not everything.

But lets leave my childhood and come back to the present.

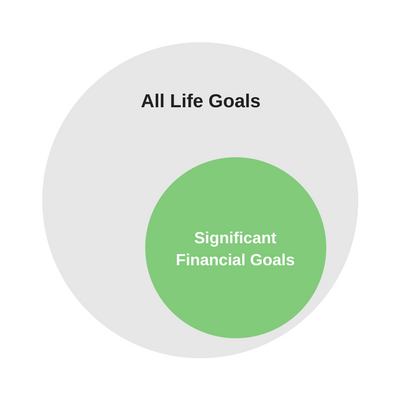

We can have several goals in life. And sadly, many of these life goals require money – Yes…. can’t do away with that.

Goals like buying a house, children’s education, their higher education, their marriage, good retired life, early retirement, living a good life even before retirement, travelling, etc. — all require money.

And hence, these life goals are also your financial goals.

There can be other life goals too that might not be clear-cut cases of being financial goals. Like helping your close relatives, etc.

So when referring to financial goals, its mainly about the ‘significant goals’ of your life that require money. By significant, it is meant that these are important as well as cannot be met through regular income. So you need to save for these goals.

For example – Your kids’ school education is obviously important. But you can manage the monthly school fee through your salary. But when it comes to children’s higher education, you cannot meet the requirement from your regular income/salary. You need to save for it for years. So that is how we identify a significant financial goal – which in this case is your child’s higher education.

Goals must be S.M.A.R.T.

This is a very popular acronym used in context of goal-setting everywhere (including financial planning).

S = Specific

M = Measurable

A = Achievable

R = Relevant

T = Timely

Without using a lot of words to explain this theoretical concept, understand it like this – when these 5 requirements (i.e. S, M, A, R and T) are taken care off while setting your goals, it becomes a well-defined and strong target and not just a weak wish.

Here is the difference:

Wish – “I think I should have a big house in future”

Goal – “I have to buy a 3BHK in Mumbai for about Rs 40 lacs in next 3 years.”

The difference is clear.

Unlike a wish, a goal is:

- Specific: Its clear what type of house is to be bought where

- Measurable: Its not using general words like ‘big or small’. It’s a 3BHK.

- Achievable: Ofcourse its achievable. We are not planning to buy a Taj Mahal here.

- Relevant – Its relevant for the person who has this as goal. It is what he wants.

- Timely – A clear deadline is set to achieve the goal

So…without doubt, your goals must be smart. Now lets move on and see how to go about setting your actual financial goals.

List down all Life Goals

Goals tell you where you want to go. And its only when you know where you are headed, you can decide what path to take. Isn’t it?

So when listing down your life goals, its imperative that you think hard. Take time to reflect on all the goals that come to your mind.

Ofcourse major ones are obvious, which include short as well as long-term financial goals – like buying a house, children’s education and marriage, retirement, etc.

But depending on your exact situation, you might have other goals that might be important for you. Like a good friend of mine is saving to gift his wife a big diamond ring on their 5th anniversary. 🙂 (I hope my wife doesn’t read this).

Please understand that as of now, you are just listing down all your goals. It doesn’t mean that all of them will be planned for and invested towards.

Pro Tip – Include your spouse when listing your goals, irrespective of whether your spouse is earning or not. It will help getting a different perspective and also because it can help avoid future disagreements about how to manage money.

Here is a sample listing:

Having several goals doesn’t increase your chance of achieving them. Its better to focus on fewer goals instead to get the best result. Its also because your income is limited and you want to use it to save for the important and correct goals.

Also, some of the things that need to be done (like reducing your unmanageable credit card debt, paying off your brother’s small personal loan, etc.) might not be your life goals. But nevertheless, they are your financial goals.

So your list of life goals gets converted into list of financial goals. Here is a list of financial goals derived from life goals (with additions and deletions where necessary):

By the way, I have used a simple excel to list down these goals. You may call it setting financial goals with help of a Financial Goals Worksheet. Though I find it easier to do it in excel, if you want, you can use simple pen and paper to do it too.

Now once you have listed down all the goals, you need to identify which are worth planning for and which aren’t.

Tag all Goals as ‘Needs’ or ‘Desires’

Next step would be to tag each of your goals as either NEEDs or DESIREs. You can use other words too but idea is simply to differentiate between essential goals and non-essential (or lets say good-to-achieve) goals.

For example – Saving for your retirement is a NEED. You can’t do away with it. But saving for a foreign trip next year is a DESIRE. It can be postponed, have its budget reduced, etc.

Here is a sample tagging for goal list that was shown earlier:

Some goals might seem like both a need as well as desire. I can quote a personal goal of mine here – Travelling. Its a DESIRE for most people no doubt. But for me, Travelling is also a NEED. 🙂

If you too are facing such a dilemma, don’t worry. Its not a big problem. Just be reasonable in tagging. Don’t tag a goal like ‘Purchasing SUV’ as a need when you are unable to even pay your bills on time.

Ideally, the goals that are NEEDs (or Essential goals) should get priority over other ones. But that is easier said than done. We are humans and we need to simultaneously take care of multiple goals. You cannot keep saving for just one important goal (like retirement) and not do anything for others. You will screw up big time.

But tagging your goals like this can help clear your thoughts about what is important and what is not.

Categorize all Goals as Short, Mid and Long Term Goals

All goals are not similar and neither have to be achieved on the same day.

So now categorize all your goals (both NEEDs and DESIREs) according to their time horizon. One way to do it as follows:

- Immediate Financial Goals (in next 1 year)

- Short-term financial goals (1 to 5 years)

- Medium term financial goal (5 to 10 years)

- Long term financial goal (10+ years)

So this is how goals of previous points can be categorized as per time available:

This time period based categorization of your financial goals gives a lot of clarity when doing financial planning. That’s because a major factor that decides where you should be investing in (i.e. which assets and financial products), is time available for the goal.

Assign Priorities to Your Goals

Now you need to assign priority to your goals. It might look similar to the earlier differentiation of Needs Vs. Wants. But its not.

If it was possible to achieve all your life goals at once with the resources you had, then financial planning would be unnecessary. And it would be an ideal world where your needs as well as desires would be satisfied on demand. Instant gratification would rule. 🙂

But it’s the real world we live in. And we do not have unlimited supply of money.

We simply cannot have everything we want and whenever we want.

We need to accept tradeoffs, as the resource available (i.e. money to be invested) is limited. So you need to prioritize your goals.

It helps to identify important goals even within the categorization we made earlier (Needs and Desires). Once identified, resources will be allocated accordingly. This ensures that important goals are taken care off first. But this also means that money may not be left to satisfy all other less priority goals.

This is the tradeoff that prioritization of goals helps in dealing with.

You decide what goals will be satisfied first and which will be second, and which won’t be done until till very last.

As an investment advisor myself, I can vouch for the importance of this prioritization. As Michael Kitces says:

Ultimately, the key may not merely be to give clients a comprehensive list of recommendations, or to tell them what steps they should take next, but instead to help them make the choice of what’s most important to them and then hold them accountable to follow through on it.

Here is a sample prioritization of the goals we are discussing as example:

The prioritization can be different for different people.

Some goals can have similar priority for some people while different for others. For example – many people are of view that children should take care of their marriage expenses. Some think otherwise. So priorities can be different.

Now what if your goal priorities change later on?

That will definitely happen in real life.

Nothing to worry. You will need to adjust your investments later on, so that they remain relevant as per your priorities then.

Now goals have been listed, categorized and prioritized. So are we done now?

No.

Aren’t we missing something?

Yes we are.

What is the cost of each Goal Today?

You cannot move ahead without knowing the costs. Isn’t it?

What is the cost of these goals today? When you answer that question, only then you will be in a position to know the real cost of the goal in future (after adjusting for inflation).

A engineering degree that cost you Rs 5 lac about a decade ago can easily cost Rs 15 lac today. Fast forward another 15 years when your child might be starting his higher studies, the cost might have gone up to Rs 50 lacs or even more.

So knowing a goal is fine. But you also need to anticipate how much it will cost in future. And the only way to know it is to realistically assess two things:

- Cost of Goal today

- Inflation applicable to the goal’s cost in future

If you fail to account for inflation, you will end up saving woefully less than what is actually required in future. And that will be a sad as well as scary situation to be in.

So here is how one can assign costs to various goals. The figures are hypothetical:

Chose Your Final Goals Wisely

Now comes the tough part. Your income is limited and it might not be sufficient to fund all your goals.

So you will need to pick the goals you want to go after.

You might consider saving for some goals first as these are important. Other goals can be saved for (or postponed) later on. For example – You might want to postpone your plan to go for a foreign trip every 2-3 years till you have bought a house (and obviously cleared off the loan).

You might also consider reducing the targets for some goals. For example – In current example, instead of saving Rs 15 lac each for two children’s marriage, you can save Rs 20 lac combined for both of them.

Here is an example of rationalization:

But How much to Invest for my Financial Goals?

You have listed your goals. You have identified which are NEEDs and which are DESIREs. You have categorized them into short, mid and long-term buckets. You have prioritized them. You know their costs today. You have further rationalized them.

Great work…

But now What?

The answer is that now you need to know 4 things:

- Cost of goals in future?

- How much you need to invest for these goals (monthly or lumpsum)?

- Where to invest for these goals?

- Whether any existing investments can be earmarked for these goals?

The answer to these questions is given by Goal-based financial planning (<– I strongly suggest you read this post)

If you are good with numbers and understand how to read numbers from real-life perspective, then you can carry out goal based financial planning yourself. Or else, you can take help of trustworthy and competent financial advisors who can help you do just that (I can help).

So after going through all the steps, your financial goals worksheet will look something like this:

Or here is another sample of how you will get an action plan to achieve your financial goals:

Be Careful about Where you Invest for different Goals

I want to highlight this point, as this is what most people get wrong when trying to do things on their own.

Different goals require different investment plan and strategies.

Using single asset allocation and risk tolerance for all your goals in the investment plan can be a big mistake. Infact, it can be disastrous.

But question is how much should you invest and how should you distribute it across various assets? Goal-based financial planning helps people understand exactly how to invest and where to invest to achieve most (if not each) of their goals.

In general, we have a fair idea about various assets. Equity gives best returns in long term but it can be risky and volatile in short term. Debt gives stable and predictable returns but these can be lower than inflation – which defeats the purpose of investing. Cash is good for liquidity and cannot be used for investment as inflation beats it.

So lets see which assets are suitable for which types of goals:

Short-term goals (Upto 5 years)

Risky assets like equities are best avoided for such goals. More so if goals are high priority or critical. Some people might still be interested in investing a small part in equity for these goals. It might work for them. But everyone should understand that any losses that you incur on the way may not be easy to recover from in time, given the short-term horizon of these goals.

Medium-term goals (between 5 and 10 years)

Investments can be made in both risky as well as in safe assets in a balanced manner. The idea is to balance the safety of capital with the need for higher returns.

Long-term goals (more than 10 years away)

One can invest in assets that have a higher long-term return potential for the long-term goals. Best suited asset for this is equity. Even then, most people fail to realize the potential of equity and invest primarily in debt instruments like EPF / PPF / Pension etc. for their ultra long term goals like retirement planning.

It is important to understand here that a long term goal will not remain long term forever. As the goal date approaches, it will effectively become a short-term goal.

For example, when you are 35, your retirement is 25 years away, i.e. its a long term goal. But when you turn 55, it will only be 5 years away, i.e. its changed into a short term financial goal. When this transition begins, you should ideally start the process of slowly reducing the riskier equity component of your goal-specific portfolio. This will reduce the risk of large losses as you near goal completion.

Note – These are general and broad goal-specific asset allocation suggestions. The exact allocations will differ from one case to other depending on several other factors.

Need help with financial goals worksheet?

Click here to grab a FREE Financial Goal Setting Excel Worksheet

Feeling Overwhelmed?

If you are reading this and already feeling a little overwhelmed with the big numbers being thrown around in name of these personal financial goals, then please relax.

Its true that financial planning is generally focused on dealing with larger financial goals. But I don’t want you to be overwhelmed and demotivated at the sight of these seemingly big numbers. They may seem distant or unachievable.

But this is where smart financial planning based on concept of goal based investing can help.

It can breakdown large financial goals into smaller and manageable pieces. So for example – you get a simple, easy to implement retirement plan that will tell you exactly how to go about building up (with small monthly investments) that multi-crore corpus you need for your retirement.

With Goals Clear, Start Working to achieve them

Its only logical to put your efforts in something that you really want to achieve.

Since now you already know what your goals are and how you need to invest for each one of them, there is only one thing left for you. And that is to take action.

You might have noticed that I have not mentioned much about saving taxes or chosing the right products (like specific mutual funds names, etc.). It is because things like tax saving are secondary. More important is ensuring that you are investing correctly for your goals. Tax saving should not come in way of proper investing plans.

Similarly, once you have finalized the goals, you can start putting in place separate investment portfolios for each of them (or group similar ones) with proper asset allocation. Goals come first and products come later.

So it will be more equity (via increasing SIP in equity mutual funds) for long term goals. On the other hand, more debt (via debt funds, bank deposits) for short term goals.

Ofcourse the goal allocations also depend on your risk appetite. But above suggestions are broad and common way to go about investing for goals of different time horizons.

But its best to find the right balance of equity and debt investments, for your unique personal financial goals. And this can be done correctly only via detailed financial planning.

So take some time out to identify, streamline and finalize your financial goals.

You should be saving and investing correctly and in line with goal-specific requirements. Investing randomly without any goal will not take you anywhere.

Hi. Very nice, helpful and descriptive post. But ‘buy a 3BHK in Mumbai for about Rs 40 lacs’ is not an achievable goal. At least 1.5 cr required.

Hi Prashant

Its just an example. 🙂 🙂

But I am sure somewhere on the outskirts of the city, it would still be possible.

Hi Dev, going through your posts have been a fantastic learning and I wish I had started this process early in life. With God’s grace, we have a home of our own and a retirement corpus that can easily take care of our current monthly expenses for next 30 years and children are well settled. There are no major unfulfilled life goals except for living a happy and peaceful life and helping others to do the same. However, there is still a temptation to enhance my investing skills and generating a superior return on my corpus with a view to use part of it for charity.

Would love to have your (and others) thoughts on it.

Ashok

Hi Ashok Ji

Thanks for your kind words. 🙂

Happy to know that you have managed to take care of all financial goals. And most importantly, are at peace with what you have achieved. This is something really worth trying to achieve for.

Going for superior returns (atleast on a small portion of your portfolio) seems worth trying for in your case as you have already made necessary arrangements for your future expenses (and goals). You can try equity MFs or if you can are ready to devote time and effort, then even direct equities.

Thanks Dev. Wonder if any of your past post talks about such a situation. Would very much appreciate any specific advise that you may like to share with me directly on my email.

Steps involved in setting financial goals are very useful for all age groups. I am a retired person and have achieved most of the goals but from your post I have conceived a new desire/need of foreign tours. For this I will set financial goal as suggested by you. Thank you.

Waiting for your new posts.

S P Srivastava, Varanasi.

That is so good to know Srivastava Ji 🙂

I love travelling and hence you can find me a bit biased towards that. You would like reading this post I wrote couple of months back

https://stableinvestor.com/2017/02/advice-chinese-man-in-egypt.html

Great Article Dev.

I guess the only missing piece for me is how to utilise/allocate existing assets and current/future income to the findings in step 8 (cost base)? And if there is a gap, how does that get filled? For example

Asset base- 1 Cr

Current Annual Income- 10 Lacs

Cost – as per step 8

How does one do that? can you add step 9 to show that?

Thanks

James

Great one again !! your articles over the years have made loads of difference to my attitude/ planning towards personal finance. you are doing a great job.

Thanks Manish 🙂

Hi Dev,

Thanks for this wonderful article. I’d say this is one of the best writings on your site (and maybe even when compared to other financial sites too). There is a reason why I say so.

I have been tracking my finances for a very long time, not very systematically, I should say and only recently, gotten organized about it. I thought I have done all the calculations and planning and projections. But deep down I knew these are all random spreadsheets and formulas and data scattered around, which I go through often and get confused.

Now, after reading this, I have re-done my sheets and there is crystal clear clarity, as to my major goals, the importance, time & investments needed etc. All laid out clearly step by step. Many thanks!

Thanks Anand

Clad you found this useful 🙂

Fantastic!!! You opened my eye, Now I’m very confident that I can achieve the way you described.

Thank You for your time spent for this great article. This would be valuable to all.

Thanks Saravanan 🙂

Thanks a lot Dev for such fantastic post…I am a regular follower of your blog, and I must admit that this post is my favorite one, given the kind of clarity it has provided to me..This is not to undermine your earlier posts…But frankly speaking this post is worth diamonds for me…Thanks a lot again…My heartliest wishes to you in your endeavours…

Thanks Arpit 🙂

Hello Dev… I am Extremely happy after reading this article and I want to give special thanks to you . I feeling confident and I am grateful to you

Thanks Andrew. 🙂 Glad you found it useful.

According to me this is a very descriptive explanation. I like your posts.

Thanks Albert 🙂

Perfect description of life goals and the role of finance in it is explained well. Great work …

Thanks Suresh 🙂

Very nice post. it’s Really helpful

Thanks Ramesh 🙂

Great words of financial wisdom..

Thanks Renuka 🙂

gem of a article

Very Informative.

I am 24 yo, Earning 32K monthly.

Can you please suggest me my Financial Planning? please.

Loved this post. There is such clear actionable advice that anyone who reads it thoroughly can really not go wrong.

Thanks 🙂

Hi Dev

This article is wonderfully explained and each clarity of do’s and don’ts have been checked out. I am started my career as a Mutual Fund Advisor definitely it will help me using these set of standards for my clients in my practice.

Thanks.

Hey,

Thanks for sharing this helpful & wonderful post. i really appreciate your hard work. this is very useful & informative for me.

thanks for sharing with us. thanks a lot.

very informative article. so helpful. such a wonderful blog. thanks for sharing this post. keep sharing.

Hi dev

Very nice descriptive and analyzed article which in fact suited my need. I am currently have a life corpus set aside and have multiple assets ( Apt, investment home, shares in equity, sip monthly around 40k) but still have a feeling that with the raise of inflation and standard of living going up n up, wondering to meet the demands of a family man with two kids, what more I have to do !! Please put your 2 cents on my situation.

Dev,

This blog and the excel template was extremely helpful. It clearly explain the steps requited for planning and ensure the journey towards financial planning. Great writing and Thank you

Great work. I am thankful to you for this post. it gave me clarity of investing.