Real Estate or Mutual Funds? This might be one of the most controversial debates I am starting on Stable Investor. But I had to write about it someday. And by the number of emails I receive from readers asking me to answer this question, it seems that there is much more than just financial logic behind this question. Peer pressure, family pressure and just getting done with this big decision in life are some, which I can think of right now.

Note – This post is a combined effort by Ajay (who has previously authored interesting posts like how to invest your surplus money and how he created a corpus of Rs 3.7 Crores in just 10 years) and myself.

But if you expect us to give you a clear answer at the end of this post, then please tone down your expectations. We do not intend to provide a thumb rule or even a judgment for that matter.

This question of whether you should invest in Real Estate (for investment) or Mutual Funds, can only be answered by you and you alone. This article should ideally be read in that spirit.

So let’s go ahead…

In words of Ajay, a home is a place to live and it should not be linked to one’s investment strategy. There should not be any second thought given about buying your 1st property for self-occupancy whether with or without tax benefits.

My take on this question is not as strong as that of Ajay. But I do agree with him about the power of equities in the long run. As far as my real estate is concerned, I am still weighing my options and am yet to finalize my long-term real estate strategy. As of today, I don’t own any personal property but my family does have a house in our native city.

So why am I delaying this decision unlike many of my friends who are already paying hefty EMIs every month?

I know it might sound odd to those who believe that one should invest in property starting with the very first salary they get. But I am sorry… I don’t belong to that school of thought. I have full faith in the power of compounding and investing in equities. And I will only buy my first piece of real estate when I am comfortable enough to service my EMIs. I don’t want to have myself stuck in years of paying EMIs where I feel burdened at the end of every month. I don’t want to be a slave of my EMIs.

But that was about me and my philosophy…. 🙂 So you can ignore it…

And for those who think that instead of paying rent, it’s better to pay EMIs – I have an answer. Paying rent might seem like an expense. But EMI also has a significant component of interest, which even in accounting term is nothing, but Expense. So this argument does not stand completely true.

Once again I repeat that the objective of this article is to highlight the differences in returns earned by investing in mutual funds and those earned by investing in a home funded through a loan, in the name of investment and tax-saving.

We have tried comparing two cases:

One where investment is made in real estate and the other where it is made in mutual funds.

So here it is…

Case 1: Real Estate Investment

Following is the data being used:

Value of Property = Rs 75 Lacs (1500 sq ft @ Rs 5000/sq ft)

Required Initial Down Payment (@20% of Property value) = Rs 15 Lacs

Loan Availed (for remaining 80%) = Rs 60 Lacs

Loan Tenure = 20 Years

Loan Interest Rate = 10.15%

Few more administrative costs are as follows:

Loan Processing Charges & Other Expenses (@2% of Property) = Rs 1.5 Lacs

Registration Fees (@10%) = Rs 7.5 Lacs

After doing some calculations which are depicted below, we arrived at quite interesting numbers.

|

And as you can see in the last column in the table above, this property has also been able to generate post-tax and expense-adjusted rental income. We used a few assumptions for rental income and expense which are as follows:

- Rentals increase by 5% every year

- Rental income from the property is taxed at 20%

- Maintenance expenses are recurring every 5 years: Rs 1 Lac (5th year), Rs 1.5 Lac (10th year), Rs 2 Lacs (15th year), and Rs 2 Lacs (20thyear)

All in all, these result in an amount of Rs 24.67 Lacs being generated from the property over a period of 20 years.

This means, that effectively the property costs about Rs 1.39 Crores as depicted in the table below:

Now as per general perception (at somewhat backed by data too), the properties are known to appreciate in price. But here, we are not talking about property prices doubling every 2-3 years. We are talking about many sensible returns ranging from 9% to 12%.

Let’s see what this part of the calculation leads us to:

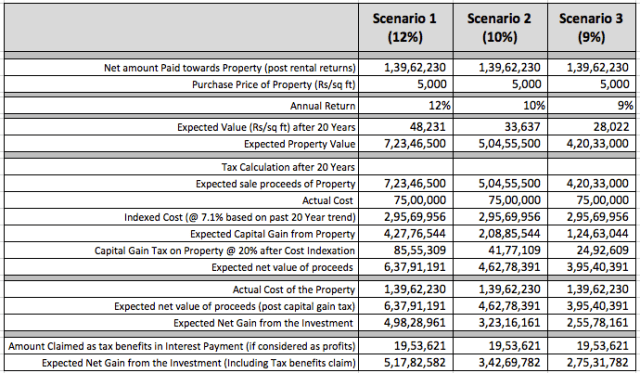

We will evaluate 3 scenarios where property appreciation is taken as 9%, 10% and 12% continuously for 20 years. And this evaluation is depicted in the table below:

Now when 3 different scenarios are considered where this property appreciates by 12%, 10% and 9%, the expected net gains are Rs 5.1 Cr, Rs 3.4 Cr and Rs 2.75 Cr respectively.

Agreed that these are some really big numbers.

But before you start putting your hands on your mouth after reading them, let’s check out the second case where we evaluate similar investments in mutual funds.

Case 2: Mutual Fund Investment

We are using the following data for this case:

Initial lumpsum investment in MF schemes of Rs 24 Lacs. This amount is equal to the sum of Initial Property Down Payment (Rs 15 Lacs), Registration Charges (Rs 7.5 Lacs) and Loan Processing fees (Rs 1.5 Lacs).

Now the EMI amount in the earlier case was Rs 58,459. This amount, in this case, can be used as a monthly SIP. But we also need to consider the tax benefit of Rs 1 Lac availed on house loan investment – which is to be equated monthly. That amounts to Rs 8333 and the resultant amount available for monthly SIP is Rs 50,126.

So here is the calculation sheet for two types of investment scenarios.

First one is where returns from MF move from the initial 12% to 7% in later years. These are conservative numbers when compared to returns given by really good MFs.

The second one is a slightly aggressive returns assumption-based analysis. Here the returns move from 15% initially to 7% in later years. But even then the returns of 15% are not that rare and have been achieved by quite a few funds in India for decades.

Now, what happens when these funds are sold after 20 years? There won’t be any tax as long term capital gains are not taxed in India for stock market returns (till March-2018).

So for an investment of Rs 1.44 Crores (lump sum + SIP of 20 years), a corpus of Rs 10.28 Crs and Rs 7.06 Crs has been achieved. And mind you, this return has been achieved despite having paid the additional tax @ 8333/- per month for 20 years. And these numbers are substantially higher than the real estate investment even after tax saving.

This means a net expected gain ranging from Rs 5.61 Crs to Rs 8.84 Crs.

Compare these numbers with those of Real Estate case and you will understand what this article is trying to point you towards.

Why do People Invest in Real Estate?

We have tried to list down a few reasons which we thought people have for investing in real estate. And here were are not talking about the 1st House but about the 2nd property, which is treated as an investment:

- There is mental comfort in buying a hard asset that you can see and feel (also applicable to gold).

- It is an asset that can be funded largely through long-term debt (75% Funded by banks). No other asset provides such a benefit.

- It is a big asset, which you can acquire and then comfortably pay back via monthly payments (EMIs) over a very long period of time. Once again, no other asset provides this benefit.

- The comfort we get by doing mental accounting about tax savings in real estate investments. One always feels happier when one is told that they don’t need to pay tax or no money would be deducted from salary, because of tax savings due to loan-funded real estate investment.

- Second income from spouse, which can be used to get additional tax benefits (by being a 1sthome loan for the spouse) by taking a home loan.

- The comfort of getting a stream of rental income. An income, which you get without working for – passive income. But most of the times, people forget about the linked expenses.

- The general opinion that it is a hedge against inflation.

- Mental fix that there is Zero Risk in real estate purchases (in reality, there are more risks than most other investments like gold and mutual funds).

- The justification that it is an investment for the next generation(s).

- High return expectations due to the recent past records (say last 15 Years).

- Black money at work!!

- Pride of owning multiple real estate investment and being known as the ‘Landlord’.

- As there is no daily ticker, the daily mental valuation of the asset does not take place.

- Mental satisfaction and happiness when disclosing to others that you own multiple properties.

- The perception that since everyone is investing in real estate and profiting from it, even I should do the same and make easy money.

- You always hear the story from neighbours that they bought a flat for Rs 900 / sq ft 15 years ago and now it is worth Rs 5000 / sq ft. Here mental maths comes into the picture. Mentally you might think that this 900 to 5000 appreciation is more than 5 times and a very profitable one. But neighbours comfortably forget to tell you about the expenses they incurred in these 15 years or in repaying loans. Actual returns are always calculated net of expenses. It’s neighbour’s envy and owner’s pride (copied from an old Onida TV advertisement). For those who want to turn Rs 900 to Rs 5000 in 15 years, it’s not that tough. You can do it at 12.1% per year.

Why Don’t People Invest in Mutual Funds?

Since you are reading Stable Investor, chances are high that you would be a mutual fund investor. But there are many who avoid mutual funds to invest in real estate. Let’s see what are the possible reasons for them to do so:

- Lack of knowledge about mutual funds and equity markets.

- Lack of understanding about the power of compounding, the power of equity as an asset class and clear knowledge of wealth building via SIP.

- Lack of knowledge about asset allocation.

- Risk and loss aversion.

- Unable to determine financial goals and estimate the amount required.

- They have already utilized all the tax benefits available to them because of home loan. Now they have no tax-incentive to invest in mutual funds. And hence they don’t do it!

- Bad past experiences. And these are primarily due to wrong fund selection or wrong time horizon or wrong advice (like combining insurance and investment or wrong thinking that saving and investing are the same).

- As daily price movement of MF through NAVs is available, the daily mental valuation of the asset forces one to take frequent buy and sell related decisions. This is driven by a general lack of patience in investors.

- Mutual Funds cannot be funded through Black Money.

- Unlike real estate, no long-term loans are available for investments in mutual funds.

- More people talk about losses made by investing in funds (for whatever reasons) and very few people talk about their success in meeting financial goals through funds.

- Mental fixation with recent huge loss events (like 2000, 2009, 2013 etc.)

- A major chunk of saved money has already gone into real estate, which leaves almost no money to invest in mutual funds.

- And as substantial money is not invested regularly in mutual funds, one does not feel that substantial money can be made through mutual funds.

- You don’t get to hear every day that a fund having a NAV of Rs 28 has grown after 15 years to Rs 805 – a return of 25% per year (Check Reliance Growth Fund). Such returns are very high ones and rare and cannot be matched by real estate investment or investments in other asset classes.

Now, let’s test your memory…

Do you remember how much did the petrol cost in the year 2000?

It was around Rs 25. As of today, it is about Rs 66. Now suppose you had invested that Rs 25 in real estate, which grew at 12.1% as mentioned few paragraphs earlier. This would have grown to Rs 139. Enough to buy 2 liters of petrol today. Now if this was invested in a mutual fund, which somehow could manage 25% return, it would have grown to Rs 711. Enough to buy at least 11 liters of petrol.

That is how equities work. That is how compounding works. That is how the value of your money is preserved and increased by investing in the right asset class for long periods of time.

Concluding Thoughts

And this is a repetition of the earlier statement. One should not give any second thought about buying your 1st property for self-occupancy, whether it is with or without tax benefits.

However, based on our comparative analysis above (and estimated returns), one should think twice (or even ten times…) before buying a second home for investment purpose. One should carefully weigh all the available data and then take a wise call. Just because your friend or family member is investing in real estate does not mean that you should also do it. You should evaluate your own financial goals and think about how you plan to achieve it, and then decide whether you want to ‘invest’ in real estate or not.

A hard and physical asset will always give a huge mental comfort and satisfaction over other financial assets like mutual funds. But it is also true that it may not always be the best available investment option. In fact, investing in house funded through a loan, is a huge long-term liability – which chokes the ability of the person to save and invest in other right instruments for the future.

In our opinion (and it is ours and you can ignore it), after the purchase of the 1st property for self-use, if there is any surplus cash left to invest, you should invest it as per your asset allocation (which includes debt, equity, gold & real estate). If the asset allocation permits you to invest in real estate, you may very well do it. But if it doesn’t, then you should refrain from investing in it. Investing in real estate for the sake of saving tax may not be the best thing to do.

As stated at the beginning of this article, this is one hell of a controversial debate. And there is not a straight-forward logical answer to it. There are no thumb rules or any other rules. The question of Real Estate Vs Mutual Funds can only be answered by you and you alone.

We have simply made an attempt to clear the myth that “Real estate investing is the only best Investment Option” available for everyone. We have done all the calculations by estimating the returns net of expenses. We cannot just ignore expenses like those who just tell you the number of times their property has appreciated in value.

Please note that this post may be biased towards Mutual Funds investments.

Do let us know about your thoughts on Real Estate vs. Mutual Fund debate.

Note (Update 2019-20): A new updated real-life case study on Mutual Funds vs Real Estate has been published. You can find it here – Mutual Funds vs Real Estate: Which is better for Investing in India (Follow Up Post 2019 Update)

Note (Update 2021-22): A new updated real-life case study on Mutual Funds vs Real Estate has been published. You can find it here – Mutual Funds vs Real Estate: Which is better (2021 Update)

Disclaimer:

Returns mentioned in this post are only assumptions and not guaranteed ones (for both Mutual Funds and Real Estate). While there is an investment return record available for mutual funds, we could not get credible investment return data for the real state (we took NHB data as a guideline). Moreover, the real estate returns very vastly from location to location.

http://www.safalniveshak.com/your-house-is-not-best-investment/..This is all I got to say..Now wait for the real estate fans to get outraged 🙂

above calculations are true Mr Nishanth, people do not think practically they just follow what others do and investing in real estate is just guarding your money but doesn’t give returns like MF do. now cities are wide spreading as and when cities spreads the property values within the city just stables at one price and doesn’t increase, its like waves in the sea real estate rates just follows the waves.

Hi Dev, Kudos on doing this calculation thoroughly taking into all possible deductions, exemptions and scenarios.

I have one suggestion though: You could use real data from NHB (although your estimate of 12% isn't too far off from the returns suggested in the NHB). http://www.nhb.org.in/Residex/Data&Graphs.php

Again, very good analysis. It is very rare to see people doing such analysis take into consideration numbers such as insurance, maintenance and a realistic decreasing rate of return from mutual funds. Good work!

There are mistakes in the analysis which has reduced the returns from real estate. Rs. 75 lakhs is deducted 2 times while calculating the net value, initially for capital gains purpose and then as part of net investment. Also, in Bangalore registration charges come to only 2%. also, interest rate of 10.15 is very high and only 9 or 9.5% is to be considered as average interest rate. the rental income should be 3 to 4% of the total cost of the property, and if self occupied no tax deduction to be made. Post tax rent income of 30000 for a property costing 75 Lakhs is very low and not realistic. With these corrections real estate returns will look better than mutual funds returns.

I don't agree with this comment. 3-4% rental income never happens. I hold equities + real estate. Dev has not even taken repair cost into account. My experience over last 10-15 years is that the rental income goes off in maintenance/repaid. As simple as that. In Chennai, a 1 to 1.2 crore flat returns 20K as rent. Maintenance cost is outside of this. Where do you get 30K rent for 75lac flat?

I agree, with you, in delhi I am getting only 15000 pm on a property of 7500000/ and spending 50000 pa on maintenance and paying taxes hardly gives 12000 pm on rental income. if I invest that much money in mutual fund with 15% return I wili get 1125000 pa or 93750 pm . If I do a sip of 93750 pm I may get return of 25% and I will feel rich. But my family members friend may not agree because of psychological reasons.

Most of us want to invest in real estates just because our friends, colleagues, cousins etc. have done it already. I’m not sure how many of us actually get into such an analysis before making any investment. The analysis Dev has done is simply outstanding. I had done a very rough calculation on a spreadsheet taking into account some of the factors that Dev has mentioned in his analysis. This analysis has given me some more insights.

20k rent per month for a flat costing Rs.75 lakhs is easy to get in Bangalore. I have no idea about Chennai. Maintenance charges are separately taken care of in the calculations.

Agree with your views Dev. But I also have seen people who regularly makes great returns in real estate investments. I think it all depends on as they say 'Circle of competence'. If you are good in real estate there is no better investment than this. But most of the retail investors are not very good in it due to the ticket size involved

Dev, as usual, a very well written article. Although, I am not too much in favour of real estate investments but one thing which goes in favour of real estate is that “they do not make it any more”. Land is constant and in very long times to come it may become the most prized commodity. And that is probably one of the reasons why large business houses are jumping into retail, SEZs etc., just to garner prime real estate. (There are many examples of some old companies surviving by encashing their real estate holdings)This is not to be confused with the present day real estate investments being done by people like you and me i.e. apartments in high rise condominiums. This is not real estate investment but buying a “product” which will depreciate with time. A huge nexus of housing loan companies and real estate developers fueled by govt. policies(created for their benefit) is playing with the hard earned money of hapless salaried individuals.

Although, I agree with your realistic returns mentioned above, but there are many cases of real estate investments (including even the apartments) which have returned around 15% CAGR in last decade. However, it is near impossible to have similar returns in the next decade. One of the reasons is control of the market by organised players and the other is over supply of “products” (read apartments in high rise condominiums). Whatever money gets made due to appreciation of land price will be made by builders and not by us individual apartment buyers. Government is also playing a ball by adding Service Tax and VAT on apartments purchase.

Shyam, seeing people making regular returns in real estate was a matter of timing. You would have seen it happening in 09 to 12 period. I have also seen and experienced it. It is not happening now. Even stock markets go through similar periods. If you have invested in any reasonably good stock or MF in 2012/13, it would have given you a pretty high return in the range of +30 or even 40%.

Awesome, the biggest con of real estate is the stress of having to pay an EMI every month. This makes one to be depend totally on job paying well, and continue working in this job however crappy the job is. Distress sell in real estate is another big disadvantage. Although my current home is paid off I am definitely looking to buy an plot/commercial property for investment, but at the current valuations I will not touch RE with a ten foot pole. I will stick with my current portfolio of Equity/Debt and wife's gold :p for now.

Methinks that RE prices are headed for a stagnation for the next 5-10 years, if not for a huge correction!

http://stableinvestor.com/2014/12/Real-Estate-House-Of-Rupees-27-Crores.html

Couple of months you did share an interesting article on the same..

I agree with Mohan. I feel that the term Real Estate is being incorrectly used only for flats. But generally it can be applied for Lands or plots where we are not buying flats but building our own on these plots, sites or whatever you call it. In Bangalore if you are investing around 75 lacs on a site the rental income is also good enough to sustain the repair cost. But if you are talking about only flats then it is just a single flat not 3-4 1BHK houses rented out.

You are correct Girish, but I think it depends on city to city and person to person. Even I don't think real estate is my cup of tea 🙂 , but there are people who has good network and they constantly look out for good deals on plots/flats, knows all the nitty gritty of the area. they know what to purchase, when to pur and keeps encashing them.

Dev – Nice Article

I have completely different take on this may be not for everyone but if one puts EMIs for first house in MFs at year 10 onwards there is a high probability that he can own a similar house with no debt

See this – https://www.tankrich.com/2015-20-dont-buy-a-house/

I think the calculations are slightly skewed against real estate as to show it down.

Few pointers:

1. Loan processing fess now not more than 10,000 or so and in my case it was only 5000

2. Not sure about the registration fees too

3. Tax relief under interest paid on Home Loan has been raised from 1.5 lacs to 2lacs p.a. (here you have assumed only Rs 1Lac)

4. Rent assumed is paltry. However it depends from city to city but for the 1st year you have assumed rent of 87,500 for a property of Rs 75 Lakhs!! That's too less! Assume something ranging from 2.3%-2.75%. Which will translate approx double the amount you assumed.

5. Also MFs charges are not accounted for! That's really surprising coming from a responsible website!

6. Adding to reasons against MFs.. The bad advice given by their MF distributors and sometimes the absence of it is the major reason of avoiding MFs.

7. Also since MFs become quite liquid after a year or two the accumulation is depended on financial discipline and hence MFs get used for the short to medium term goals rather thank long (10+ or 15+ years)

Don't want to add more points but Real Estate definitely gives the physical pleasure of investing like staying in it or having a family residing in it and inviting you for a dinner 😉

Also a good property enhances your social standing in your family when you actually need it. I need to show off my property today at 32 or 33 of my age rather than at 52 or 53 when all is lost. 😛

Lastly Real estate investment should be restricted to 2-3 (3 in worst cases) After that the above points tend more favourable to MFs and people should avoid their real estate fixations and diversify through MFs.

Regards

perfect,aptly replied.I second your thought process.

See 90% people staying in Cities like Bangalore, NCR, Mumbai are not investing in plots till the time its not the “excess” money they may have. So if we keep this to flats then its more fruitful. And 87000 for a property of 75 lakhs is unseen for me. I stayed in Gurgaon and easily a flat costing 75 lakhs fetches a rent of approx 20-24k per month. And what about Tax Benefits? Its 2 lakhs p.a. why assumed here as 1 lakhs?

BUY FEW RE AND THEN GET INVOLVED IN CIVIL CASES.A PERSON WILL PUT A FLAG AND WILL CLAIM YOUR PLOT TO BE HIS ANCESTRAL PROPERTY. GO TO COURT AND FIGHT FOR 20 YRS.OR PAY HIM 50%. USE FORCE AND HIS WIFE WILL COME TEARING HER CLOTHES AND ABUSING. U WILL FORGET ABOUT INVESTMENTS FOR EVER. I HAD MULTIPLE RE.SOLD ALL OF THEM.INVESTED IN MARKETS AND SLEEP PEACEFULLY NOW.INVESTMENTS IN RE IS NOW FOR GOONS ONLY.I AM NOT TALKING ABOUT 1 OR 2 RE. BUY 10 OF THEM AND THEN FACE THE MUSIC..

Well written article again, Dev!

There are some fundamental points about RE and MF that I would like to highlight.

1. Self researched RE vs MF where we acknowledge that we dont understand equities enough so rely on experts.

More apt comparison would be performance of REIT vs MF or equity vs RE.

2. Highly leveraged RE vs equity fully paid for. What if RE is fully paid for too. Will the difference be as wide as shown in example?

3. Buffet says invest in only businesses you understand. Can we say the same about the asset classes? Ie invest only in asset classes one understands.

4. Currently, like any growing economy, Indian RE market surely isn't suitable for rental income but for capital appreciation only. Rent can just take care of property tax, maintenance etc.

firstly i appreciate dev and ajays post in opening the pandoras box. my doubts 1.flat is not real estate.2.Flat is not an asset it is a liability according to latest defn.3.plots give phenomenal returns not houses becos it becomes older and less valuable.4.plots rise in value phenomenally becos available land space on earth surface diminishes constantly while human population explodes contantly creating a constant demand supply gap in favor of plots. my verdict is in favor of RE for above mentioned reasons of course risks are in RE..

few days ago only i found this site.i feel dev has the making of a successful fund manager.pl consider this dev.

Thanks Abhijit 🙂

But I think that a major chunk of credit must go to my partner in doing this analysis – Ajay. I am really short of words when it comes to praising how lucidly, Ajay is able to bring real life scenarios to excel. 🙂

🙂 Its good to have different opinions…

Helps look at the problem or the issue from different perspectives

Post tax and other expenses, rental income of 30K is only shown in first row, which only considers the months starting from May 2015 and upto December 2015.

And rental in general are decent enough, till the time we book expenses (annual like insurance, taxes, etc) and five-yearly ones (like maintenance). It is this very point which we also wanted to highlight. That just saying that a rental income of 20K may not be correct. We also need to look at the expenses like taxes, insurance, etc.

Agreed Shyam. Have myself seen people make amazing returns from real estate. But these are more of exceptions than rules when it comes to middle class.

Interesting thoughts Girish. And the idea of taking reasonable returns was to remain grounded. And we have done it even in case of MFs. We have even gone on to lower the returns from MF in later years to 7% – which is even lesser than risk-free rates.

But really interesting insights of treating few types of real estates as 'Products'.

Yes Ashutosh 🙂

Agreed Abhi. Even I get jitters from the though of EMIs running into years. Its like one becomes a slave of EMIs. But to be honest, even I might do it when the day comes. But my current stand is to build equity and MF portfolio before taking the jump into RE.

Really interesting article Tankrich 🙂

Thanks for sharing…

Interesting words Doctor 🙂

Its actually a good insight for those who might be thinking about multiple properties…

dear dev ,one of my doctor friend whose father was an mla in maharashtra got a flat from govt quota.he leased it to reliance.after few years the manager who stayed there refused to vacate.when reliance asked for it ,he simply left the job.after getting tired of running after lawyers and police he finally sold it to him for 30% of market price.(that too when his father was an mla and union leader). dear dev just stay away from re for the sake of investment.it is hugely risky.”kum khao gum khao na hakeem ke jao na hakim ke jao”

Thanks raju!

Agree with your points. The topic here is about investing in flats (not for self occupancy) using EMI as investment and for tax saving purpose.

Investing in a plot by cash is a different ball game and it also involves other risks. It can also provide substantial returns.

Regards

Ajay

Dear Abhinav,

Although we have been fair in our asssumptions for both the cases, it is possible that we have assumed more or less on some areas that could skew the whole argument in favor of mutual funds. However, it is not intentional.

Probably as I am a hardcore equity fund investor, it is quite possible my arguements favor equity investment and equally and core real estate investor is likely to argue in favor of real estate investment.

We also would like to reply pointwise below for the benefit of readers:

1. We took the loan processing charges rate from axis bank which is Up to 1% of the loan amount subject to a minimum of Rs. 10,0000/- There are other incidental expenses all put together we considered as additional 1%, which in our opinion is reasonable to expect (e.g. Legal opinion, verification of title in registar office,lawyer fees to review builders agreement document etc., transportation etc.)

2. Regarding registration fees, again we referred to TN rates, may be slightly on higher side when compared with other states.

3. Our understanding is that for the 2nd home loan the tax benefits is only up to 1Lac.

4. 87,500 is assumed for 6months period only (since calculation starts from May 2015) We have considered 1,57,00 for the 1st year and increased it by 5% every year. It is also possible there may be many months in the 20year period without rents however this is not considered. It is assumed that it is rented throughout with a 5% increase every year (which is difficult in real terms in our opinion).

5. The returns from mutual fund are considered /shown post the expenses. Infact, Reliance growth fund posted 25% PA over a 15 years period net of all the expenses.

6. Agree. But in real estate no professional is advising you but you are ready to do the research understand and take a risk. Fund reasearch is much more easy than the real estate.

7. Yes. This is where the attitude needs to change to invest for long term goals. Long term investment in MF pays.. that's what we are arguing about.

We have generally covered all your other points in Why do People invest in real estate part.

Hope above is okay to you…

Regards

Dear Mr. Mohan,

Registration charges are based on TN rates which is close to 9% and by the time you take possesion of flats it reaches 10%. You can check the website and the recent buyers. The interest is based on Axis Bank 20Year Fixed rate (you can check in their web site) for simplicity of calculation, we considered a 20year fixed rate which is more realistic way of calculating it.

A friend of mine bought a propery (7year old) in Alwarpet, chennai (near Kamalhassan's house) for 2.5crore, the rental value is only 35000/- a month. The yeild is not so high in all markets. I would prefer to be tenant in that house than being a owner.

Hi,

The 87000 is for half year only not for full year…

Also, refer to the detailed reply for your comments above…

Hi,

We analyzed NHB data and then only chose the 3 points. Actually there is a vast difference on returns (e.g. Hyderabad did not do well at all, Bangalore in nominal growth, Chennai was normal)…

Thanks Dev!!

Hi,

Although me and Dev put this post, I did not put my own experience in real estate experience and my personal view in this post, which I would like to add here:

My first investment in 1996 was in a plot, which I sold just before the 2008 crisis with a net gain of 10 X my investment amount. I sold it because, I felt that those rates are unsustainable. Although, it dipped during the crisis, but it is still on its way up. But, I have no regrets about selling.

My second major investment was in 2002 in a Independent house, the cost of the land has appreciated some 12 x times in 10Years. This property is for my end use, it doesn’t matter if it multiplies.

So my past experience with real estate has been plesant. Although, I still have capacity to buy / invest in real estate, I have the following reasons for not buying it:

The property price (what you pay for a flat) is much higher compared to what you pay in Developed Countries (if you could buy there). Even in places like Dubai, that has got excellent infrastructure, the cost of real estate is much cheaper than my place (chennai).

Atelast in Chennai (i think same holds good for most other cities), there is absolutely no infrastructure and ameneities to support such a huge growth in high rise buildings. It may come in future but it will take another 5 to 10 years and still you know we are not going to get all what we want as amenities. Even the climate in chenai is so harsh.

The developers take the investors for a ride by the time they handover the flats. What is promised is not delivered and you cannot fight against the developers (who got the time for it).

A friend of mine invested in Hiranandani and DLF projects in chennai worth 1Crore each and he is now being asked to pay almost 20% more than what is agreed referring to terms and conditions. The agreement is always one sided favouring developers. He has got no other option but to pay. Otherwise you end up in court and wate time or shouting in front of promoters house (as seen recently in TV).

It is a nexus between banks, developers and politics. Of course, the political corrupt black money plays a big role in real estate.

If there is a crash, it will hurt many people. But, it may or may not happen in near future. if there is no crash, there could be a time correction and that could suppress the long term returns.

If you are a value investor, you will not invest in it. Well, you may look like fool to others who are investing in it!

Accumulate cash and wait for the right opportunity to buy it and I am sure there will be opportunity in future at some point….

Hi,

1. REIT is not yet launched for retail investor and no investment returns data is available. It is difficult to compare in this situation. In my opinion, REIT post expenses and taxes in the hands of investors are not likely to beat the equity returns.

2. Here again the topic is about investing in flats (not for self occupancy) using EMI as investment and for tax saving purpose versus investing the same money in Equity Mutual Funds. If invested using cash (such a huge sum), the returns may differ, but in equity investing such huge some in one shot may not be recommended just for mental comfort (although our earlier post proved that anything above 10year period can be invested as lumpsum mode on equity). Still I think, if the timing in equity is right or even partly right, it will beat real estate – flat returns. Plot may be a different ball game depends on many factors…

3. Agree. Invest in what you understand. Avoid the rest or try to understand before investing.

4. Agree.

if i had purchased a resale individual house without loan and after 20 years how much will i get and how much if i had invested in mutual funds how will i get? Arent mutual funds risk. Sometime stock market collapses like few years before. I dont know much about share market just a common man. Can u explain which is better

Yes, I would be happy If we are proven completely wrong… It will help to correct my way of investing…

Mr. Parag Parikh's once told in an interview about real estate, people think that buying a house using a loan is an investment (specially 2nd and 3rd Home). However they are actually buying a long term liability. Unless you buy it with your own cash in full, it is not an investment at all.

Unfortunately, India lost another value investing legends, Mr. Parag Parikh, on 3rd May 2015. Mr. Parikh died in a car accident in Omaha, US, while on his way to the airport after attending the annual shareholders’ meeting of Warren Buffett’s Berkshire Hathaway.

Dear Mr. Mohan

For quite sometime, Bangalore rental yield is one of the best you can get in India. It is not the same in other place. It is probably due to large migrant population who rent rather than owning it. It is also due to high salary levels of IT industry. If there is a crisis in IT industry Bangalore will be the most affected market as well.

Couldn't have said it better… However, did you include the fact that in the case where we invest in MF, we still do end up paying rent? Shouldn't this be factored in?

Nice rejoinder…

agree completely here…

Flats can be an asset if they are sold off within 5-6 years… Typically, in 5-6 years, the area around the flat develops extensively, and can increase the sale price substantially. After one point, returns can dip significantly. Though development still happens, percentage wise, the highest development is in the initial years. An appropriate analogy would be:

the growth between 1 and 10 is 10x, but to get 10x returns from 10 means price has to go to 100!

For example.. If we have a flat purchased for 45 lakhs and after 5 years, it is worth 80 lakhs, it might be a great idea to sell at this rate. You've earned a CAGR of 12.2% year on year. You can pay off the loans, thus drastically reducing the interest component which you end up paying. You'll have a huge amount of money available in your hands for investment in other areas.

What happens if you continue? Depreciation, leakages, maintenance headaches. Just imagine keeping 80 lakhs in the bank for a year… You'd earn around 7.5 lakhs interest per year. Would the flat increase proportionally in the coming years (enough to beat the combination of base of 9% returns from bank plus the EMI interest if you DIDN't purchase?)

In my opinion, the term real estate is only usable for LAND… plain, unbuilt land! Least investment, and maximal returns without any overheads, depreciation. For security, a small house can be built and lived in or rented at a small profit.

Hi,

I would like to add another important point probably we missed in the post. Apart from the point mentioned in the post that the growth is enough to buy 2 litres of petrol in case of real estate and 11litres in case of equity investment, to buy the same, you need to sell the whole property to take the money out. Whereas in equity you can sell partly to suit your needs and the rest will continue to grow to maintain one's life style. This is a significant advantage over real estate which most of the investors tend to ignore.

We took petrol as a simple example for cost comparison, for a large amount such as children education or marriage, you will feel the difference and comfort in holding equity over real estate.

Bharat,

This post is all about 2nd house and not about the 1st house which in our opinion one must buy for self occupancy. So end up paying rent is applicable here. The rental income is already part of the calculation.

Please do refer to this post for some interesting data about real estate http://wisewealthadvisors.com/2015/04/20/some-interesting-real-estate-data/

If 24 Lacs is reduced to 21 Lacs the end returns will be reduced by 19Lacs in case of 12% PA returns and around 50Lacs in case of 15% PA returns from mutual fund. The same can be added to real estate if the returns if you think 6% should be the tax rate (atleast in TN case it is not).

Onceagain I copy the 5 year return analysis from mutual funds over 20years (16 data points), which was there in our earlier post…

Out of the 16 Data points (for 5 Year periods), lumpsum investments in the FIPPF gave annual returns ranging from 3.56% to 54.89%.

Out of 16 data points, FIPPF gave single digit returns twice i.e. 3.56% & 6.96%. Also, twice it gave abnormal returns of 54.89% & 47.30%. Both these excesses (great for those who got it), were because of the amazing bull run which ended in 2007-2008.

If we were to remove these outliers on both up and down side, FIPPF returns ranged from 15.14% to 37.89%. Range of returns from FD remain same at 5.5% to 13%.

There was not even a single period in these 16 data points, where FIPPF gave negative returns.

12 times out of 16, FIPPF gave returns between 15.14% and 37.89% annualized. This points to 75% chance of achieving similar results. And if we were to add the outliers on higher side, it will be 14 out of 16 times – which is more than 85% chance of making superior returns.

In Rupee terms, Rs 100,000 invested in FIPPF could have grown anywhere between Rs 119,193 to Rs 891,663 (in blocks of 5 years over 16 such periods). If the excesses removed on both up and downside (caused mainly because of 2007-08 bull market, followed by crash in 2008/2009), then Rs 100,000 invested in FIPP could have grown anywhere between Rs 198,821 to Rs 498,596. Majority of the times, Rs 100,000 invested in FIPP would have grown to a value between Rs 200,000 to Rs 300,000

Despite the above past records over a 16years period, most of the retail investor are still not trusting that mutual funds could build long term wealth…

You had mentioned to buy a flat for 45lacs and sell it at 80Lacs in 5 year period. For a 1000sqft flat, 4500per sqft is to become 8000/- sqft. I remember in a resanobly developed area in Chennai (Velachery) which is close to the IT corridor, a preferrred destination for migrant and local IT employees was 3500/- per sqft in 2005 – 6 and it is still only 7000/- after 10Years (approx. 7% PA) and the old property is generally 20% cheaper. Except for the recent past there is no record that the flats appreciated so fast in the such a short term to provide the returns you have mentioned. Between 1995 and 2000, there were substantial drop in property values most of us dont remeber that now.

Buying real estate (preferably plot) using cash after thorough diligience for a long term (some times 20/30 years is one of the best investment option and is not the only option.

My uncle purchased a land in very outskirts of chennai in 82 for 10,000 rs. and the market rate for the same is 1Crore now. It is 23.2% PA returns. Post tax it will fetch 80 lacs (22% PA returns post tax). Here you can get hardly 50% in white rest becomes a black money, can you handle 50Lacs black money… so what happens here is that again this goes in to circulation to buy another land to pay as black money and it goes on.

Need to believe that MF can build wealth for you in the long term, if you have discipline and patience!

1. REIT has been India at least for last 8-9 years. Just that it has been regularized recently. Piramal indiareit has given irr of 26% pretax. Post tax maybe 16-20%. Surely not bad enough to write it off completely. Agreed min investment then was 25Lacs, which is down to 1-2Lacs now depending on scheme.

2. Quote “topic is about investing in flats (not for self occupancy) using EMI as investment and for tax saving purpose versus investing the same money in Equity Mutual Funds.”

If this is the case, the title of the article becomes misleading. I do agree with your point that investing in 2nd house with big % as home loan is a very bad idea. But the article seems to be completely writing off RE. As mentioned in some of your earlier comments, plots can be good investments. Commercial space was in very bad shape, so those who bought 2years back got great deals in Mumbai, roi turns out to be even 11-12% pretax.

1. I totally acknowledge two main con's of RE – ticket size and illiquidity. But what I am trying to convey here is if we take out the interest component of the table (meaning self funded), the picture is quite different. 100 rupees earning 10 and 1cr earning 10L, roi is still 10%.

2. When buffet says equity beats any other form, he is absolutely right because he understands that asset class completely. This statement can't be shown to a grocery shop owner and make him invest in equity MF. The earlier quote of 'invest only in asset classes you understand' seems universal to me and applicable to all.

3. REITs are now regulated and are required to do full disclosures. Off course reits will take time to earn credibility that MF enjoy these days. But good REIT houses like piramal are already there.

Disclaimer- I am a big fan of equity.

Totally agree… actually, my supposition of 80 lakhs was on the quite higher side. It was just an example, and I agree that getting that kind of appreciation would be extremely unlikely.

very precisely said dev i liked it and useful to me.

Thanks Sudhakar 🙂

Glad you found it useful

Those were some really eye-opening points Ajay. Thanks once again for increasing the value this article brings to the readers 🙂

Yes Ajay. It was a big loss for the investing fraternity in India.

I was lucky to have interacted with him a few times on mails. And apart from being a true-blood investor, he was one of the humble human beings I had ever come across. I was pleasantly surprised when he replied to one of the mails which I sent him the very first time.

There is so much to learn from him

Thanks Sudhakar. And its very kind of you to have given such a comment 🙂

If want B+ AB+ kidney or want to sell kidney for money due to financial breakdown. Contact us 8050773651 whatsAap

Very informative post and helpful for taking future decisions.Thanks

The way common people have become rich in real estate, I dont think any other business could have done so. Starting a business and making it successful is beyond capabilities of 90% of people because adequate knowledge and contacts are required for that. See the semi-literate villagers around delhi-ncr roaming in luxury cars. Many of them are multi billionaires. Can any other business would have made them multi-billionaire? absolutely no. Real Estate will always remain first choice of indian people and it should be. The proud you will feel in possessing a kothi of 5 crore cannot be given by mutual fund papers of 5 crore.

And once they squander away the money they are on the roads. Easy come easy go. Only a responsible few may invest for security and they could turn out to be clever. They would have sold their ancestral property and hence it would have been easy. Easy come……

Thanks Dev and Ajay for the knowledge. Very useful analysis. I will now venture into MFs et al. RE is more risky than MFs. The best part is liquidity which is needed in times of distress.

Nice post, real estate is better for investment purpose.

Hi Dev.Great article.What if we purchase commercial property?I mean flats get not more than 3-5% in rental yield.However commercial property gets decent yield and capital appreciation.What do you think?

Although I agree with mutual fund part. In real estate investment, the scenario assumes that the buyer is lending the maximum amount of loan possible. And then repaying it over the maximum tenure. Thus increasing the cost of investment to more than double. If the same investment is made without the loan involved, then the returns will be better than shown here.

you have not taken into account land purchase in real estate investment,it sometimes substantially more than a flat

This is a very informative article. But we would have liked to see the comparison of different loan tenures and loan amounts with respective comparable mutual fund plans. Like 15L down payment 60L loan for 15 years; 37.5L upfront and 37.5L loan for 15 years etc. etc. Looking forward to see such comparisons.

It’s a very good comparison.Can similar comparison be done with respect to land purchase.Reason being is investment in land/plot normally gives better returns than flat purchase

Surely. It can be done. Will try to do it soon.

@ashish ji your analysis is insightful for second house. Please write an article on purchase of first house for a young professional in 30s.since that is a consumption decision.

Good analysis. I agree with the part of “Mutual Funds”, Instead of investing in Real Estate just by taking the loans, I would prefer Mutual Funds investment due to the low investment with good returns, which can also help us with retirement planning

Hi Ashish, You have provided a good information and it will be really useful for the people who are just confused and I would recommend people to invest in real estate instead of mutual funds!

Hi,

Good analysis, but I think you missed 1 point while analyzing mutual funds investment which is : the rent paid by mutual fund investor and I think that should be deducted from investment per month.Like in your case the amount invested should be: 50126 – (rent paid).

In that case also mutual funds will win :).

It’s wonderful information, really a better investment on real estate property.

Really a very nice article.

2 more points can be added.

1. Liquidation of mutual fund is very easy compared to sale of property.

2. We can defer the decision to buy house currently and buy new house as per choice from mutual fund returns of 25 to 30 years in new construction that will last more (compared to house bought 25 to 30 years back from home loan instead of investing more on mutual fnds.)

Also we will have more money left in hand after 25 to 30 years even after buying same type of house which can be added to retirement fund.

It is definitely a good Article , But I must say that we must understand that 1st property is not an investment it is a basic need , secondly what ever rentals we have shared hv been of residential market which would only be 2.5 to 3 % , However if you invest in Commercial property you will surely get 5 to 6 % which is not bad atall bcz after every 10 years your commercial property would hv 100 % jump. (In most of the locations even more ) Even MF are also very good. Atleast the datas show this only. Now to conclude I would say that an intelligent person would be one who would invest atleast in 4 categories , 1st one should be PPF (of course can be max 1.5 lakhs p.a) 2nd should be SIP , 3rd should be some FD and 4th should be Commercial Property… This is the way I have invested and seen a Corpus growing at a descent level. Like all your needs are not of the same level all investments cannot give same returns but One should plan for all kinds of requirement and should ensure that they get regular income to run House hold , should save for retirement (PPF) should hv some liquid options like FD for immediate unforeseen expenses and some MF to make your money work for you .

Really good one. I took home without prior knowing the SIP and mutual funds. So now at-least i started saving in SIP, My husband pay EMI and I pay in mutual funds. It will good atleast they start 5 years before getting the home loan so some pressure on financial part will be reduced. So from a year i am more interested on SIP rather than other saving like FD

Awesome analysis Dev and stable investor.

I am in minus of around 70 lakhs today with jobless condition with having no investment on any MF or real estates.

Really need a serious planning as I am sure of coming back to track of regular income.

Thats the case with so many people in this economy, who have invested in real estate

awesome inputs Dev for people who are investing in real estates

great inputs given by you dev…

Do visit our blogs too . We are leading home builders in Coimbatore