Recently, I was talking to a relative about how he managed money when I realized that despite being young, he was somehow not too convinced about the potential of equity for long-term wealth creation.

So I thought I will try to influence him with some simple data. And once I did that, his mind started working in ways that I wanted it to.

Mission (was) accomplished. 😉

I thought of sharing that dataset here.

Imagine you can invest just Rs 1 lakh every year. So over a period of 20 years, you would be investing a total of Rs 20 lakh.

Now, what would be the value of these investments over the years?

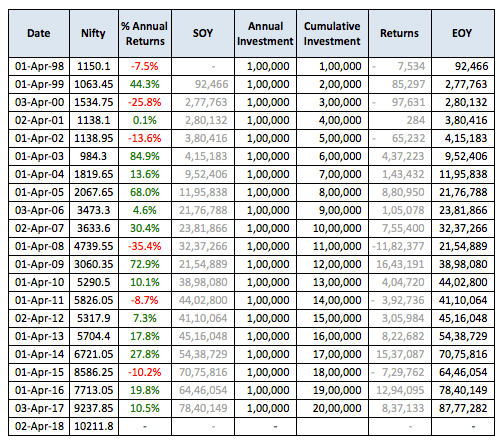

Sometime back I had crunched some data that I had on my laptop. So I took the Nifty50 data of the 20 years (from 1997 to 20218) and showed the below table to my relative:

After investing Rs 20 lakh over 20 years, the value of investments was about Rs 90 lakh. This is when the investments were made in January every year.

A large figure of Rs 90 lakh excited this relative of mine.

But he had a valid question – Since markets fluctuate, what would have happened if instead of investing in January, he invested in other months? Would he still get such great investment returns?

So I showed him the data for the months of April, July, and October. Have a look.

By investing Rs 1 lakh in April every year in Nifty50 for the past 20 years, the value of investments would have become Rs 87 lakh. Not bad.

Then I took another quarter.

By investing Rs 1 lac in July every year in Nifty50 for the past 20 years, the value of investments would have become Rs 92 lakh. Not bad at all.

By investing Rs 1 lac in October every year in Nifty50 for the past 20 years, the value of investments would have become Rs 94 lakh. Not bad again.

Ofcourse the figures differ depending on the months we invest in. But the final figure still is good enough to show how wealth is created over the years when investing in equity.

And just to drive home the point, I also compared this with Rs 1 lakh investment in PPF for the 20 year period from 1997-2018. Here is what I found:

By investing Rs 1 lakh every year in PPF for 20 years, the value of investments would have become approx. Rs 52 lakh. Not bad but much lower than what was possible via equity.

Please don’t think that I am trying to say that PPF is not a good product. I personally like PPF and feel that PPF is a great debt product.

So if you understand asset allocation and understand the need to have debt in the portfolio, the PPF is a great option. (Try this PPF excel calculator)

But ignoring equities just because they can be volatile in short term is not wise. Equity will go up as well as down. It’s not a bank FD. But if you stick to it for long, the returns delivered are higher than debt products.

And that is what I wanted to convince my relative too. He seems to be convinced now. 🙂

I told him that I was not saying that investing in debt (and getting 6-8% p.a.) was bad. I was just saying that if one is willing to digest even a bit of volatility and stay the course, one can make a lot of money via equities in the long run.

And who doesn’t want a bit more money?

If you believe that money does not hold the key to most parts of your life, then you’d be lying to yourself.

And even before you think about investing, you got to get your savings mindset right.

If you expect to save what’s left after paying all the bills, you’ll be very disappointed. You’ll wind up spending a lot of money and saving very little. If you are not very sure about how much you spend, then get yourself an expense tracker. Track what you are spending every month. You will be surprised to know that your basic expenses are very low. if you want to build your wealth (like have a Rs 5 crore retirement corpus or a much bigger Rs 10 crore retirement corpus), then at first you need to get serious about tracking your spending, savings, and investments. There are actually tons of tools available that you can use to track expenses etc. Do check some broker sites like to discover what analytics and tools can be useful for you. Once you get a hold of your basics right. Only then you should look at sophisticated approaches that are best left for high-networth individuals. At least in India, we don’t have to worry about data security, etc. that is quite vulnerable in other smaller developing or underdeveloped nations.

But enough diversion. Let’s come back to equity investing.

I also shared with him the idea of investing on a monthly basis via SIP in equity funds if he (like most people) doesn’t have lumpsum amounts to invest. He got inspired by the several SIP success stories that one can easily find. He liked the idea that one can start with any SIP amount, to begin with, and then increase it later on as and when the comfort level with equity increases. Like:

- Invest Rs 5000 SIP per month

- Invest Rs 10000 SIP per month

- Invest Rs 15000 SIP per month

- Invest Rs 20000 SIP per month

- Invest Rs 25000 SIP per month

- Invest Rs 50000 SIP per month

- Invest Rs 1 lac SIP per month

So if you too feel that someone needs a little push to consider equity for long-term investments, then you can use the examples above to convince them.

Excellent detailed analysis.

Many and many thanks for your Innovative and Unique Analysis based on Nifty ( especially by distinguishing it by different MONTHS like Jan , April etc.) , which is of real help to us..