Some time back, I made my 7 resolutions for 2015. One of the resolutions which I made was to increase my mutual fund SIP contribution this year by atleast 10%. This initially may seem like a simple thing to do, but believe me…it can have a really big impact on how much wealth you can accumulate eventually.

And this is what I will try to convince you about here…

Let us suppose that I stay in a job for next few decades. I turned 30 few days back. So for all practical purposes, I have another 30 years before I retire.

Let’s also assume that as of now, I do not have any savings or investments.

Now let’s take up 3 different scenarios:

Scenario 1

I start a SIP of Rs 10,000 every month for next 30 years. I am making a conservative assumption that a well diversified mutual fund scheme will be able to deliver 12% every year. There are schemes in India which have done almost double of that for almost a decade. But lets not be over-optimistic, and stick to 12% for this and other scenarios.

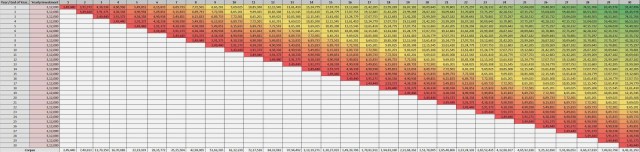

So after 30 years of Rs 10K monthly investment, the corpus will finally reach a cool Rs 3.24 Crores!! Details of the calculations can be found in image below. Please click to enlarge it:

|

| Scenario 1: SIP of Rs 10K for 30 years |

Scenario 2

I start with a SIP of Rs 10,000 every month. But for next 30 years, I increase my SIP contribution by 10% every year. i.e. I invest Rs 10,000 per month in first year…followed by Rs 11,000 every month in second year….Rs 12,100 in third year..and so on. Here again, the return assumptions are kept at a conservative 12%.

So after 30 years of increasing SIPs (which started at 10K a month, with 10% annual increase), the corpus will finally reach a (way cooler) Rs 8.40 Crores!! Details of the calculations in image below:

|

| Scenario 2: SIP starting with Rs 10K, which increases 10% every year for next 30 years |

So you see the difference. A simple 10% increase in your monthly SIP, more than doubles your final corpus. Not bad.

But wait…..

You must be wondering that instead of just increasing this SIP every year, what would happen if you started with higher amounts and kept it constant?

The answer to your question is provided in the third scenario.

Scenario 3

To achieve a corpus which is almost equal to one achieved in second scenario, i.e. Rs 8.40 Crores…you need to start with, and continue paying Rs 26,000 every month. Once again the detailed calculations are given in image below:

|

| Scenario 3: Constant SIP of Rs 26K for next 30 years |

As you see in second and third scenarios, you can achieve the same target amount (Rs 8.4 Cr) by choosing two different approaches. So question now is…

Which one to choose?

At first glance, it might seem that increasing SIP is better than Constant SIP as it is more convenient. It also seems to be in line with a simple common-sense based thought that:

Income Rises – Expenses Rise Too – So Should Investments

Why should SIP be kept constant when your income is rising? Your investment (through SIP) should also increase. Think for yourself… If you started a 10K SIP when you were earning 50K some years back, and you are proudly flaunting this 10K SIP even today…when currently you earn more than Rs 1.5 lac a month, then it is something stupid. You wont become rich!

An important point to consider here is that even though both scenarios result in Rs 8.4 Crores at the end of 30 years, the total investments made by you in both cases will differ substantially.

In scenario 3, the SIP is constant at Rs 26,000 for all 30 years. Whereas in increasing SIP model, you start with Rs 10,000 and it continues to increase every year. In 12th year, the SIP amount in increasing SIP scenario crosses Rs 26,000 (equal to constant SIP value).

In year 18, monthly SIP will exceed Rs 50,000. In year 26, it will exceed Rs 1 lac a month.

When you compare these numbers with constant SIP number of Rs 26,000, these might seem like very big numbers. But decades from now, these would be very small numbers considering the increase in annual income and inflation, etc.

But as I said, total investment in both cases will differ substantially. In constant SIP scenario, you will be making a total investment of Rs 93.6 Lacs in 30 years. But in increasing SIP scenario, your total investment would be Rs 1.97 Crores (almost twice!).

So does it mean that its better to start with a bigger amount in constant SIP instead of increasing one?? As in both cases…the end result is same – Rs 8.4 crores.

But before you decide, read further…

When we start investing, its not easy to allocate very big amounts towards Mutual Fund SIPs. Suppose you start earning Rs 40,000 as your first salary. You under normal circumstances, will not be able to shell out Rs 26,000 every month. But can easily manage Rs 10,000. And with rising income, you can keep increasing your SIP amounts (Scenario 2).

Honestly speaking, there is nothing like starting a large SIP very early in your life.

Honestly speaking, there is nothing like starting a large SIP very early in your life.

What do you think? What strategies do you use to boost your SIPs?

12% return for 30 years…Wouldn't that be a stretch …We might have got 20-25% CAGR for the past decade from good MFs…but thats from a very low base …as the Indian economy grows and the country develops , the 12% CAGR return for say 10-15 years might need to be replaced by a 9% return assumption for the next 1015 years…..As the base effect comes into play , gravity will exert its effect on returns , inevitably..

Hi Dev,

First of all, many congratulations on the excellent work you are doing.

However, there are a few points that I haven't found being elaborated on. I would like to know the impact of churn and Mutual Fund expenses on the stated returns that asset management companies proclaim. Has there been any study done on the same ? Is the 12% interest you've mentioned above, considering these two factors also ?

Regards,

Rahul

Considering an investor who is starting now (at a very high PE),

I'm really not sure what the return is going to be for the next 3-4

years. While it doesn't impact 10-15+ year returns, it's easy to get disillusioned in the next few years if returns are bad.

I think we need to realistically assume 10% return over such a long term, and a 5% increase in SIP amount. Both are realistic. Anything beyond is fantastic, but I don't think we can base our assumptions on higher returns.

Hi Govar

You are correct that when one starts at high PEs, its tough to stay course when markets correct in future. But that is what long term investing is all about. If one can give sufficient time and effort to market analysis, then it makes sense to wait out the high PE periods and invest in lump sums at lower ones. But that is tough to do. For average investors, sticking with well diversified funds for atleast 10 years is what makes sense.

For choosing return of 12%, I was of the view that was a conservative number. But seeing the comments, it seems that probably, its not conservative for 30 years. But think of it…if we are using any number closer or lower than 10%, then why should we even stay in equities? We are better off being in risk less asset classes. But I understand the point which you are making. Equities atleast have a chance of doing better than 10%, which may not be the case with other assets.

And I agree..5% increase is more realistic than 10%. But higher it can be, better it is.

Agree with your views partially Nishant…

For choosing return of 12%, I was of the view that was a conservative number looking at the past. But think of it…if we are using any number closer or lower than 10%, then why should we even stay in equities? We are better off being in riskless asset classes.

But I agree that as and when Indian economy matures, the returns coming from markets would also go down.

Thanks Rahul

Not sure whether such a study has been undertaken. The choice of number 12% is taking into account the average returns by markets / funds in past and toning down those numbers for purpose of future projections.

Dev, thanks for your efforts and this article. I guess our fellow members are just looking at current market situations where P/E is around 24 and all index are already high. But one thing we are forgetting is we are a developing nation which will take another 30-40 year to be fully developed, matured economy. And to support this we can compare our economy with US /European nations.

We as a nation has Foreign reserve at around $ 340 B where as Apple as a company has $170 B as cash. So this example is sufficient what a developed economy is. And to go to that level Indian economy need to grow anywhere between 8-10 % every year for next 30-40 years. (Check what kind of returns market had given during 2002-2008 where economy grew at an average of 6%.

Looking at our GDP (compared to developed nations) and endless opportunities, 12% is realistic returns we can get from Equities for next 30 years.

Can you share the MFs which you use for your regular SIPs? Want to understand the rationale behind selecting a particular type of fund for one's requirement.

I hold same view as Nishant. Premium above inflation is bound to reduce as inflation decreases.

It will be nice to see the above graph with inflation included

Thanks Mr Vadhiya 🙂

I am also of the same view KP 🙂

And simply speaking, if as long term investors in equities, we are not able to get 3-4% more than risk-free asset classes, then its better to stick with the latter. Why take the risk.

The inflation adjusted returns would definitely be lower. But the point I am trying to make here is the power of systematic investments (increased every year by small %like 5% or 10%) to create long term wealth.

Personally, I choose funds which have been in existence for almost a decade and have proven their mettle. I used to invest in index funds too, but not am more inclined on going for the actively managed funds. Will do a post detailing my funds and other details soon and then you can have your answer Kalpesh 🙂

Nishanth..I personally still believe that we will take more than 30 years to become actually 'developed', if we consider quality of life, industrial might and similar things. But that's a personal assumption.

Having said that, we can actually divide this 30 year period into 2 or may 3 parts – 12% for first 20 years followed by 8% for next 10 years. That will moderate the final corpus down to more saner levels given the lower expectations.

But my intent of doing this post was to show the power of doing simple things to create wealth – like increasing SIP by a small percentage every year. But its good to have a counter view which I welcome. 🙂 The lower the assumptions (expectations), better it is 🙂

Replied to Nishanth above 🙂 But thanks for helping me relook at the assumptions which I made for 30 year period.

Hi,

I am new to your Posts and i already started loving you plans for investing.

but my doubt is with Scenario 2 (which i consider to be non-practical)

Considering increasing SIP every year but 10% doesn’t sound hard or impossible but once you take this to excel, that is where my doubts started – as per your calculation one will be depositing Rs. 50,544 every month on 18th year which looks fine for me, keeping my career growth and all. After 18th year it becomes very hard – 30th year one may have to spent Rs 1,58,631 per month in SIP. Total 12 month amount will be Rs.19,03,572, (19L) I don’t thinks it is possible. Assuming i save 30% of my income, so by the time I retire my annual salary should be around 60 Lakh. (Is it possible ?) assume that is possible, in that case 8 to 9 corers will be a peanut for me (for a guy who gets 60L as annual income).

am I doing something wrong or am I failing to understand something?

Please revert back to explain.

P.S. – Keep up the good job.

Hi Gouthaman, I understand why you are confused. Let me explain it with todays scenario. Assume you have retired today with 6lacs pa instead of the 60lacs 30 years later and your corpus is 80lacs instead of the 8 crores…I am just reducing the zeroes, the proportion remains the same. At 8% return from a fixed income source, you get 53000 pm as interest. Surely, you can manage with this amount today provided you don’t have any other liabilities.