I was recently talking to a friend and he casually asked me ‘How can I double my money?’

I asked him – ‘How much time do you have to double your money?’

He said that he would want it to happen as soon as possible. Maybe in a year if not earlier. 🙂

I was happy he didn’t say months or even days – as many investors aim for.

There is something remarkably attractive and glamorous about the concept of doubling your money. I am no psychologist but honestly, these 3 words ‘double your money’ – do give a high.

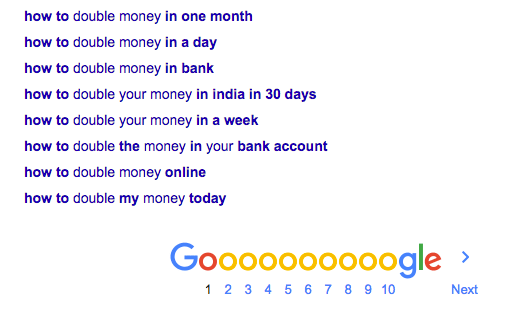

Try searching for doubling money on Google and it will gladly give you further suggestions (based on what people have already been searching for):

Wow!

- how to double money in one month

- how to double money in a day

- how to double money in 6 months

- how to double money in 1 year

- how to double money in bank

- how to double your money in India in 30 days

- how to double your money in a week

- how to double my money today

- 10 quick ways to double your money

- 5 quick ways to double your money

- and what not!

People indeed are in a real hurry to double their money! 🙂

But this post is not about how I can double money in a few years or months or even days. Rather it’s about sharing a simple rule to help you estimate how much time it takes to double your money.

And many of you already know it.

This is the Rule of 72.

And apart from telling money doubling time period or the rate at which investments need to grow to double, it can help you avoid being cheated! Yes. It can protect you from various people (agents selling various financial products) who can take you for a ride if you are not quick with basic maths.

So please pay attention.

Rule of 72

The following is a simple depiction of the rule, which can be used to answer your money doubling questions:

Time in Years x Annual Returns = 72

This might not seem logical to purists but this works in most simple cases.

And it can answer two questions that we all are interested in:

- How long will it take to Double your Investment?

- What is the required Rate of Return to Double your Investment?

So let’s see…

Q.1 – How long will it take to Double your Investment?

In order to calculate the number of years to double your investment, simply Divide 72 by the Rate of Return (or Interest).

No. of Years to double your Money = 72 / (Rate of Return or Interest)

For example, if you invest in a financial product that gives a fixed return of 8%, then your money will double in 9 years i.e. 72 divided by 8. So you now know that the popular debt instrument PPF (that gives around 8%), can double your money in 8 to 10 years (approx. as actual PPF rate changes frequently now).

Let’s take another example.

What if you are investing in an asset that gives you 15% returns? The answer to the ‘number of years required to double your money’ is 4.8 years.

But remember that this happens when returns are fixed at 15%. Equity can give an average 15% returns in the long run. But the equity returns are uneven and not in a straight line.

Here is how money doubles at different rates of returns:

Use this rule of 72 for answering basic questions of financial planning.

Ok done.

Suppose you estimate that for your new-born child’s marriage at age 24, you will need about Rs 40 lac (in future).

Now you have some surplus money that you want to keep aside for this goal. But you want to know whether this surplus money is enough or not.

So the rule of 72 can help you here.

Assuming you earn 9% assured return on your investment, you need 8 years to double your money (72/9 = 8). For the second doubling, you need another 8 years. And another 8 years for third doubling. In total, your money will double thrice in 24 years (8+8+8 years). Therefore, if you have an investible surplus of Rs 5 lac today (that can be invested at 9%), then you will get your Rs 40 lac in 24 years time without any new investment.

Current Surplus – Rs 5 lac

After 8 years – Rs 10 lac (Rs 5 lac doubles @ 9% in 8 years)

After 16 years – Rs 20 lac (Rs 10 lac doubles @ 9% in another 8 years)

After 24 years – Rs 40 lac (Rs 20 lac doubles @ 9% in another 8 years)

But if you don’t have Rs 5 lac to park away for 24 years or there are no assets to give you that kind of assured return, then you might have to invest more systematically for your financial goal.

So as you see, the Rule of 72 does give some basic idea here.

Now let’s take the next question

Q.2 – What is the Required Rate of Return to Double your Investment?

This question can be answered using the same rule differently.

Suppose you want to invest Rs 5 lac and more importantly, want to double money in 5 years. What is the rate of return you need?

The answer is 14.4%, i.e. 72/5.

What if you wanted to double this Rs 5 lac in 10 years?

The answer is 7.2%, i.e. 72/10.

If you observe carefully, your required rate of return tells you one very important thing. And that is, where to invest?

If you need 14.4% returns, equity is the best option. For 7.2%, even the debt instruments will be sufficient.

Your required rate of return will help you identify the right asset class to invest in and the proper asset allocation that you should follow. You cannot expect 15% returns if you are investing in bank FDs. You only get returns that are in line with the average returns associated with the chosen asset class.

The attraction of doubling money can pull people towards various options which are not suitable for common savers and investors. Two common examples are currency trading (or currency derivatives trading) and cryptocurrencies.

The Indian Rupee has been sliding against the US dollar in recent times and many people have this perception that maybe, entering into currency trading might be a good way to generate some good returns.

But in spite of the potential to do very well in these markets (and I know a few people who have actually done it), the fact is that it’s not as easy as most people think it is. It requires effort and skill to learn currency trading in India before you can actually do it profitably. And please do not go blindly by the alluring forex trading advertisements that are plastered all over the internet. Remember that forex or derivative trading is not a get-rich-quick method as the online advertisements make it out to be. That doesn’t happen. It’s a skill and takes time to learn and profit from.

Another recent phenomenon (which has lost a lot of its charm now) was the easy-money perception of crypto-currencies.

Here again, the people believed that this is a way to get rich overnight and so hoards of investors started joining the party. But the crash that happened eventually has left most people with a bad taste for crypto-investments.

I know the magnetic attraction of doubling money can pull people towards ‘get rich quick’ schemes. But you need to protect yourself from making such mistakes.

How to use Rule of 72 to save yourself from being Fooled?

Doing calculations related to Rule of 72 are fairly simple. You can easily do it on your mobile phone’s calculator if not in the head.

So if some insurance or mutual fund agent tells you that he can help you double your money in 3 years, you can easily calculate that he is talking about 24% annual returns (=72/3).

This is not easy to achieve and you know it. He is fooling you. Just walk out from there. Remember this:

https://twitter.com/StableInvestor/status/885012265463894016

The rule of 72 can be used very effectively to avoid being cheated. It sends out a clear message to the person trying to fool you that you know enough maths to not be fooled. 🙂

So now you are armed with a small tool – the Rule of 72 – which will tell you in a matter of seconds, how long will it take to double your money. As for the question of how to Double Your Money, the answer is not as simple as this thumb rule of 72.

Note – The Rule of 72 is not 100% accurate and should be used with caution and only for rough estimates. It is at best an approximation tool. When doing calculations for your actual financial goals, you need to do more extensive and realistic calculations.

Remember that for most people, the way to wealth is typically on the slow lane. Keep your expenses down, invest wisely and regularly, have a long-term orientation and let compounding help you. You will surely see multiple doubling of your investments in years to come.

Excellent article Dev and beautifully articulated.