It was difficult to not make money last year (in 2017).

In fact if you did not do well last year, you should do some soul-searching as to why your boat was not lifted in a rising tide. 🙂

But jokes apart, let’s focus on something interesting:

Market Timing – something that all of us want and try to do.

I borrow a simple but brilliant example shared by Nooresh here and here:

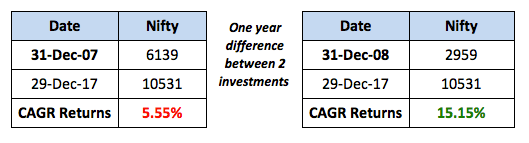

This is the Difference between buying near the Top and buying near the bottom.

This simple data point tells that inspite of being difficult, timing can be very important to your actual returns (more so in lumpsum investing).

Being good with timing is great. Being average with timing is fine too. But being bad with timing is unpardonable from a wealth creation perspective. Here is one super example of how you can create enormous wealth by just investing Rs 1 lakh every year in Indian markets.

It is difficult and that is why there are very few good and successful investors.

Isn’t it?

Others who don’t belong to that category are better off not trying too much to time and stick with regular systematic investing via mutual fund SIPs and doing some stock picking if they know how to do it correctly.

So how can one time the markets?

Difficult to answer as I am no Buffett.

But some indicators can help – like looking at valuations and trying to intelligently gauge when things become too stretched. But beware – just considering one data point and making investment decisions is foolish. This is akin to developing a framework and then falling into a trap due to framework-induced blindness. That can kill a portfolio.

On that note, I thought I will extend the above example a little further to show the impact of being right across the years and not just between two data points.

Let’s see what happens to two investors who invested:

- in end-2007 and other

- in end-2008

Here is what their annual year-end CAGRs were at the end of every year till 2017. This will show what both these investors had to go through:

As is evident, the investor in Nifty (at end-2007) never got a chance to see even risk-free 8% kind of CAGR! So much for investing for higher returns in a risky asset. 🙂 (For simplicity, I am ignoring movements within the year.)

On the other hand, the second investor (who began in end-2008) did very well. His CAGRs were great across the years.

Both were buy-and-hold for 9-10 years. But actual returns were decided based on when they bought into the market.

This seems like market timing. Isn’t it?

So be it. This is a fact. Even if someone is not able to catch the exact top or the exact bottom.

Here is further extension and comparison.

Different investors investing at each-year ends from 2009 to 2014 went through different portfolio CAGR returns and ofcourse, mental ups and downs 😉

CAGR % of the investment made in Dec-2009 over the years:

CAGR % of the investment made in Dec-2010 over the years:

CAGR % of the investment made in Dec-2011 over the years:

CAGR % of the investment made in Dec-2012 over the years:

CAGR % of the investment made in Dec-2013 over the years:

CAGR % of the investment made in Dec-2014 over the years:

Timing is important. There is no denying it. Getting it approximately right is still fine. But don’t get it wrong big time. 😉

I have already written at length about how valuations can help you see future to some extent.

Most investors need to understand that (very) high valuations mean increased risk of poor returns in (atleast) near future. This is true most of the times. But this is not guaranteed.

Read the above paragraph again.

I repeat. Nothing is guaranteed in stock markets.

New all-time high doesn’t mean markets will fall off the cliff. In fact, new all-time highs generally lead to more new all-time highs. Similarly, high valuation alone may not lead to a big crash. As many people are waiting for it these days.

In investing, there has always been the search for the holy grail. 🙂 A model that works 100% of the time and in all market conditions.

Don’t get me wrong. I am not saying that one should invest at high valuations. I am just highlighting that timing can work wonders but if you know what you are getting into really correctly.

We may never have the full insight to time the markets perfectly. But we can learn some lessons by looking at the past market behaviour and performance in light of things like valuations and growth prospects. We also know that markets will go up and down, will get overvalued, crash, will get undervalued and then recover to repeat the cycle.

So what to do?

Remember that most often than not, the consensus is the enemy of alpha.

But don’t take a very aggressive stance just for the sake of being contrarian. More so, if you don’t have the capacity to take such risks. And be honest with your judgement about having such a capacity. Most people overestimate their ability to accept being wrong (proof).

Take measured risks. Have the asset allocation mentality and create a smart and resilient portfolio strategy that gives cognizance to both averages and outlier extreme scenarios. And then, take small tactical calls to tilt your portfolio as and when you feel the need to (using some smart strategy / advice or both).

This is for those who have a hands-on approach towards investing. For others who want their investments to achieve their financial goals, its best to stick to goal-based investing and invest according to a financial plan.

Timing the market is a fools errand in my opinion. Once you start you can’t stop either! Maybe you get a good entry but then panic on a good exit. Humans are very irrational.

If someone has a long time horizon which is a must for solid investment returns they should invests early and often. Consistency and simplicity rule.

Is your opinion here based on personal knowledge and experience of timing? If not, it is just a bland (and biased) statement.

You state,” once you start, you cant stop” and also ” panic on a good exit” and further “humans are irrational”. Arent these very broad generalisations?

Personal inabilities will reflect in ALL aspects of your life- not just market timing. That does not take away merits of market timing itself- just your inability (or perhaps unwillingness?) to do it consistently.

Dev; a very good analysis. And i greatly appreciate all your studies that you post on twitter and on this page. I completely agree with your thesis. Timing the market can reap huge rewards and this is something we can realise if we analyse the crashes of 1992, 2000 and 2008. I dont wish to go into details as your heat map on the site is so precise on this. And one more thing which people dont write about much is the cost to dividend yield that accrues once you acquire a stock at its low. With high dividends that the PSU’s dole out, the dividend yield soars to double digits. Appreciate if you can find time and work on cost to divided yield ( should a person time and invest in a market when the p/e is 12 or so).

Warren Buffet has been sitting on a lot of cash since the last few years and today it is close to 100 billion USD. Why doesnt he invest? I am sure he is waiting for the crash because he can acquire assets at very low prices. He is a big timer of the markets. Thanks Dev and keep enlightening us with your splendid analysis.

While it is true that investing a lumpsum at a market high (high P/E) does negatively impact returns, it need not necessarily be as dire a scenario as presented above. Investing in a good mutual fund, as against just considering the index returns as illustrated above, improves the returns. For the same period (31-Dec-2017 to 29-Dec-2017), following are some of the mutual funds returns.

12.05 – Quantum Long Term Equity Fund

11.00 – ICICI Prudential Dynamic Plan

10.87 – Franklin India Prima Plus Fund

9.09 – Franklin India Bluechip Fund

Wonderful post Dev.

It is been 9 years, market knew only one direction i.e upside. Seen few corrections but not big Crash. Also previous ‘Crash’ period stayed only for one year max. One has to stay out of the market for decade or so, if one has to wait for big crash to invest. People have gone through many shocks (demo etc..) and upcoming crash if any shall pass too.

Now enough theories have come to protect from downside. One such example is SIP. A genuine investor is not afraid of big crash anymore. Infact he is looking forward to it.

But then many are in the market without understanding just like irresponsible drivers on the road. A crash would make lot of these novice guys ‘experts’ in future and more experts are good for the markets. Still people are finding it thrill in IPO boom, PE 150 level stocks, trading in F&O and hot themes (smart towns, electric vehicles and so on).

It is a wait and watch for U turn or Turnaround.