In our previous post, we saw that Indian markets are presently trading at PEG ratio of 0.97. We arrived at this figure by dividing current P/E of 16.7 by average growth rate (in last 18 years)of 17.1%.

|

| Click to enlarge |

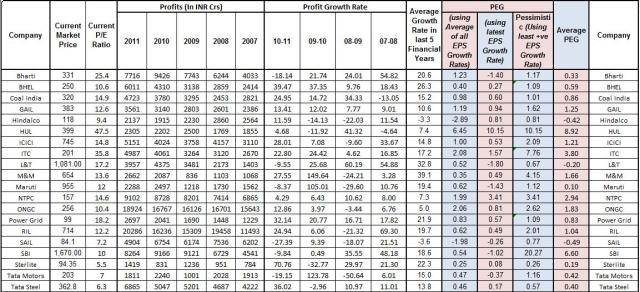

- Out of 50 Nifty stocks, we have selected 20 stocks. Basis of selection is our preference for companies which can called as stable stocks and which won’t be in any trouble in case the markets decide to close for next 10 years.

- Before we move further, please make sure that you understand what exactly is a PEG Ratio?

- We have chosen EPS growth rates to represent growth rates of a company. One can also use any other growth rates.

- For each company, we have calculated 3 PEG Ratios –

- Using latest EPS Growth Rates (2010-2011)

- Using Average of all EPS growth rates in last 5 years

- Using least positive EPS growth rates in last 5 years

- Afterwards, we calculated another PEG for each company – Average PEG – which is an arithmetic average of previous three PEGs.

- Normally, a PEG greater than 1 indicates an overvalued company, and less than 1 indicates an undervalued company. But we must understand that PEG is just a ratio and it should always be looked in conjunction with other ratios and numbers.

- For instance, a company like Bharti has an average PEG of 0.33, which is quite an attractive number when looked at on a standalone basis. But if we consider that Bharti operates in a highly competitive industry; has loads of debt due to 3G fee payments and African expansion; has decreasing average revenues per user (ARPU) and has a negative PEG(!) for current fiscal, the number 0.33 may not look so attractive.

- But there are also few companies like BHEL (0.59), PowerGrid (0.83), Tata Steel (0.40) and Tata Motors (0.42) which have considerable moat (competitive advantage & operations in industries having high entry barriers) and can be said to be available at good valuations. But once again, one should understand that stock like Tata Motors are rate sensitive and cyclical. And under current global circumstances, may slip further.

- A company like Sterlite Industries (pegged by few as future RIL) is available at a ridiculous PEG of 0.19 (or 0.25, 0.08, 0.26). But that does not mean that it is going to become a future multibagger. Similarly, Maruti is available at PEG of 0.10(!)

- Then there behemoths like SBI which may be available at outrageous mathematically calculated PEG of 6.6, but are worth investing as there current PEG stands at 0.54. But one should also consider rise in NPAs of SBI and other factors before investing.