After procrastinating for months, I am finally sharing names of companies which are part of Dead Monk’s Portfolio (DMP).

But before that, here is a gentle reminder of what to expect from this portfolio.

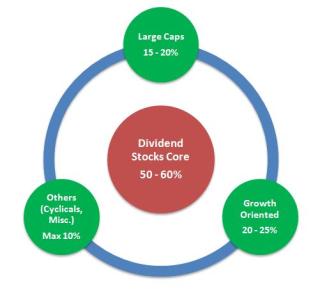

In previous post discussing (or rather rethinking) Portfolio Structure & Composition, I mentioned that for DMP, I would stick with Core Satellite structure and a maximum of 15 stocks in the portfolio. You can read more about the reasoning here.

|

| Structure of Dead Monk’s Portfolio |

In a follow-up post deliberating the need to find more dividend paying companies & stocks from other sectors, I mentioned that most of the stock in existing DMP pay decent dividends. But just to be on a safer side, I would also keep an eye for new dividend candidates, in case I decide to kick out some of the existing stocks. There is good bad news and bad news on this front. I have removed one dividend payer – Graphite India from the core. And next bad news is that I have not found a suitable replacement for this company. 🙁 Hopefully, I would find it soon enough.

Another point to note here is that no. of stocks in DMP has been reduced from 15 to 9. This is because of one above mentioned removal, as well few more removals from satellite part of the portfolio. I have also not named specific companies in Misc (Satellite) part of the portfolio. This part deals specifically with short term and speculative bets and is more dynamic (changing) than rest of the portfolio.

Out of the 9 stocks, 7 were part of original portfolio too. Two new entrants are marked with a ‘*’.

So here are the 9 stocks –

ONGC

Clariant Chemicals

Balmer Lawrie & Co.

Tata Investment Corporation

Axis Bank

ITC *

Yes Bank

IDFC *

Cairn India

| 9 Stocks in Dead Monk’s Portfolio |

I would have personally loved to add more stocks in this list to achieve higher diversification. For record, only 4 sectors namely Energy, Chemicals, Financials & FMCG are part of this portfolio. You can say that this kind of diversification may not be sufficient. But this portfolio is in line with my own risk appetite and understanding of certain sectors. I would prefer to stick with only a few companies and business which I understand rather than venturing out dangerously in areas I don’t understand. I may be missing out on potential multibaggers here. But that is a price which I am ready to pay to have a stable, ever growing portfolio of stocks which I am ready to hold for decades and not just years.

Note – You might say that this portfolio is not stable at all. It has been reworked in less than 2 years itself. Correct. It’s true that I have taken the liberty to change (reduce) the no. of stocks in the portfolio. But this is because I myself am learning newer things about myself and my personal investment psychology. I am arranging a long term portfolio around my personality rather than it being the other way round. Anyways, most of these 9 stocks were already a part of the original portfolio. So change is there, but it’s not an earth shattering one. 🙂

I have already covered about most of these companies in detail as provided in a list below.

One particular business which has seen some drastic changes in last few months is Clariant Chemicals. I am personally not very sure as to how to take a call on this one. But because of management’s proven track record and respectable dividend policy, I have decided to stick with the company for time being. But you can take a call yourself by reading my thoughts on Clariant Chemicals and also weighing the consequences of some recent developments (link).

As far as ITC is concerned, please be aware that this is a business which I like, but maybe not at current valuations. So one can wait for valuations to come down. Or if one is investing for years to come, a steady and disciplined buying of ITC’s share can be considered.

I would leave you with these thoughts and this ‘link-heavy’ post. Rest assured that I have put most of my money where my mouth is. 😉 Do share your views about these nine companies and also share your list of stocks which you would be buying for next few decades.

______