Note: This post has been written by Ajay S., a regular reader. I have been interacting regularly with him since we got in touch regarding my SIP Case Study last month. Ajay made many useful suggestions, which I eventually used for the last part of the interesting analysis. In our email conversations, it became clear that he had a vast experience in Mutual Fund investing. So I requested him to share his experiences and learnings (plus the SIP success story 2023) with all the readers of Stable Investor. And he gladly accepted the offer.

The first part of this story is about his actual experiences over the last 10 years. The second part of the series will be more about the learnings which can be used as guidelines by other mutual fund investors.

So over to Ajay, who shares his experience of mutual fund investing below:

__________________

Till 2004, I was of the opinion that stock market investing was not for ordinary people. And that the terms like ‘Saving’ and ‘Investing’ generally referred to depositing money in bank deposits. And this opinion is probably formed because I come from a middle-class family and none of my family members have ever had to do anything with the stock markets.

Also a few other people, whom we knew and who invested in stocks, were the ones who lost quite a lot of money in markets. This again kept me away from the markets.

All I knew was that bank deposits, postal deposits, chit funds and LIC were for Savings; and if there was a need to make an ‘investment’, I could buy land if I had sufficient money.

So this is my story…

I became an NRI in 1995 as I had come to the Gulf for employment. In 1997, I bought a plot of land (because someone told me to buy it). Later on in 2001, I constructed a house for self-occupancy as my family wanted a place which we could call as a home. And luckily for me, the good part was that buying of plot as well as the construction of the house was all done with personal savings, without any loans or debt.

I was lucky that I built my house much before the crazy real estate boom began. And I have no hesitation in saying that it was purely because of my need and partially because of luck that I was ahead of the boom.

In 1998, an American Insurance company agent promptly approached and duped me. He convinced me about how I should save for my future and almost forced me to buy a US Dollar endowment policy – it hardly gave 0% return, yes 0% after 10years of regular annual payment. And I realized this only after 2006. But once this realization occurred to me, I promptly chose to convert it into a term plan for the next 10 years as there was an option to do it.

In 2003, when my first child was born, I promptly called a life insurance agent in Gulf and took a Child Marriage and Education policy. In this policy, I had to invest on a yearly basis for the next 18 years. It was a US Dollar-denominated LIC endowment policy – it hardly gave 2% bonus every year despite paying regular annual premium. My reason for buying this policy was to be a responsible father, who was saving for his child’s future. But to be honest, I was doing it without having any knowledge about what long term investment was all about, and more importantly, without having any set target in mind.

In 2003, banks deposit rates started coming down and the dollar started becoming stronger. I felt that it was better to keep money in dollars, even if it fetches a lower rate. And that is because it will get compensated by the exchange rate – due to rupee depreciation over the holding period. With this thought in mind, I again bought a single payment US Dollar-denominated endowment life insurance policy for a 5-year term. I was treating it more like a US Dollar fixed deposit. 🙂 Unfortunately, the returns were less than 4% per year as I did not get the exchange rate benefit. And the reason for it was that even after 5 years, Dollar-INR rate remained more or less at the same levels.

By 2003, I was in a good-to-be situation, where I was saving a considerable amount of cash. And more importantly, I was free from any kind of loan. At this juncture, I got fooled once again. A LIC agent inIndiafooled me into buying a so-called good a policy named Jeevan Anand (Read Should you Surrender LIC New Jeevan Anand?). To cut the long story short, the policy is hardly earning 5% despite paying annual premiums regularly for last 10+ years. A good policy indeed!!

By 2003, stock markets had started gaining momentum and IPOs were all rage. Personally, I didn’t know anything about IPOs at all. All I was hearing on news channels and from friends, who had invested in IPOs, was that it was a way of making easy money….and that too quickly. Being attracted to the glamour of quick money, I approached a broker and promptly opened a Demat/trading account. And I did this without even knowing what exactly a share was and how it worked, etc. The broker, being as helpful as an angel, promptly helped me apply for various IPOs. Luckily for me, I somehow got invested only in good, established companies without even knowing anything about them. Some of these were TCS, ONGC, PETLNG, etc. But without knowing the real potential of these companies, I sold them whenever I made a small profit.

Since I dealt a lot with my broker for IPO investing, these guys started recommending mutual funds to me too. They recommended many NFOs and sector funds to me. Not because these were good for me, but because these paid higher commissions to them. And they always recommended me to chose the dividend option, so that I could get back some of the money back in my hand. But as far as I understand now, the real reason for this was to give me a feeling that I was making money. And this in turn helped them, to easily convince me to re-invest with them in other NFOs and funds that they recommended. I became a cyclical commission-making machine for them. But I had no clue about it. All I knew was that I bought a fund and the fund was giving dividends. Broadly speaking, I had full faith on what my broker wanted me to do.

By 2005, I got more accustomed to the concepts of money management and mutual funds. I even started tracking my funds’ annualized returns on a 5-year basis. And at that time, it showed a healthy (rather, very healthy) 25% per year. At that time, my total investment in mutual funds was hardly anything to say about. Mostly, I was churning the funds as per my broker’s recommendations(which benefitted him the most).

With the kind of returns my fund’s portfolio was showing, and the dividend I was getting from these funds, I came to the conclusion that, making money in stock markets was very easy. Even at this juncture, I was completely unaware of the Dotcom crash or the No-Return periods after 1995 or the Asian crisis of 1998. The 5 years annualized return of mutual funds looked good, only because of the 2003-2004 Bull Run. However, because of my excitement at seeing the profits and because I was getting dividends, I had already invested close to Rs 3 Lacs in mutual funds.

As the bull market progressed through 2004-2005, and pulled many novices into the market, I started investing in secondary markets too. But it was purely based on business channel tips & newspaper recommendations. In my quest of making some quick money, I started putting money in companies that I had not even heard off!! You can imagine the risks I was taking when I tell you that I invested in shares of companies like GTC, Manugraph, Betala, Nocil, Kohinoor…only God knows what these companies did…

I simply thought that all stocks will make money for me.

How foolish of me?

But due to losses in these unknown companies (although small), I realized that I should only buy shares of large companies. But I still didn’t know which stocks to buy and why to buy them. It was still very random for me, even though I was ready to hold for the long term. And the money I made in TCS, ONGC and ICICI gave me this foolish confidence, that I could not lose money if I stick with large caps.

It was during this time that I fortunately came across a financial guide on investing fromPersonalFn. And as far as I am concerned, it was the turning point of my investment journey…or in fact, it was the starting point. I was not a voracious book reader (although I read a lot of blogs, articles and newspapers)…..however, this guide had me interested. And that was because it was short and simple, and more importantly, it spoke about all the foolish things I was doing in my investments. At that time, this guide was like Benjamin Graham’sIntelligent Investorto me. It taught me a lot about goal-based investing and how to use a range of mutual funds and direct stock investments to achieve my goals. Honestly, it was like a god-sent material for me. 🙂

I realized that despite working for more than 15 years (with 10 spent in the Gulf), and also being a good saver, I did not have any plan for the future and was goal-less. All I was doing was to buy some insurance products and some random Mutual Fund and stocks.

I approachedPersonalFNto prepare a financial plan and got in touch with a very capable and honest financial planner. During the planning part, I set my goals and the financial plan was ready for investment in line with my risk appetite and the asset allocation.

To cut the long story short, I set a goal of Rs 3 Crores by 2025 for retirement corpus and Rs 1 Crore by 2021 for my child’s education and marriage.

A monthly SIP target of Rs 60,000 was worked out for me. This amount had to be invested in Mutual Funds for my future goals. Though it’s true that I missed out on a good part of my younger age before I started proper investing, I would say that I was still lucky enough not to have any loans at that time when I eventually did start.

By April 2006, I consolidated all my existing funds to the chosen fund as per my financial plan and started SIP investing for the 1sttime in a disciplined manner. I decided that no matter what happens, I will invest at least Rs 60,000 every month towards my goals. And I also intended to invest more to cover up for the lost time of 15 years.

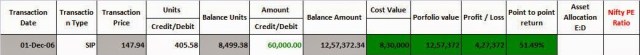

Just after a month (in May 2006), there was a significant fall in markets (it had something to do with the commodity price collapse on LME). And by June 2006, about 20% of my portfolio (Rs 1.1 Lacs from Rs 6.9 Lacs) had disappeared due to this market correction. But I told myself that I had to stick to my plans no matter what. Markets eventually recovered and went on to make some good gains over the next 6 months. By December 2006, my portfolio was sitting at 50% point-to-point return.(See entries for 1-Dec-2006 in the Table 1 below)

My investments in mutual funds continued from 2006 to 2008 and I remained loyal to my 60K SIP. Rest of the surplus money went into Fixed Deposits, Liquid Funds and Insurance premiums. I thus built the debt side of the portfolio too. But still I did not bother much about my asset allocation at that point of time.

While I could sense and for that matter, actually see the euphoria building up around me in November 2007, I didn’t do anything. The media propelled euphoria went over the roof around November 2007 as there was a general consensus that GDP will grow at 9+ percent for many years to come. I simply continued with my SIP. At one point, I even doubled my SIP investments as I got a substantial raise in my income. And this I did without any regard to market valuations at that time.

By Jan 2008, my portfolio had peaked with a point-to-point return (since 2006) of 79.27% (See entries for 1-Jan-2008 in Table 1).

An investment of 17 Lacs had turned into Rs 31 Lacs in just 18+ months. No one was bothered about market valuations and almost all market analysts were publishing much higher targets, and justifying them with the now (in)famous theory of disconnect between Indian economy and the global market. At this point, Nifty PE Ratio was 27.64. But I only came to know about this in 2010.

And then came the Crash of 2008. Until then, I had never seen my portfolio getting slaughtered in a big way. After the crash, the markets started drifting downwards. By July 2008, while my investments went up from Rs 17 Lacs to Rs 29 Lacs (due to my increased SIP and additional purchase – seeing the market fall), the actual profits of my portfolio were completely wiped out and became negative for the first time (see the return figures of 01-July-2008).

Yes…from almost double (of my actual investments) in January 2008, the returns turned negative within just 6 months!! That is how ruthless the markets can be.

Actually in July 2008, the markets came to a reasonable level where Nifty PE was around 16.6. The media also started recommending that this steep correction presented one of the best opportunities that an investor can get (since 2004). I too decided to increase my SIP between April 2008 and August 2008. And I did this by breaking some of the fixed deposits. I also invested some additional money through direct stock investing. Frankly what I was doing was to average out my investments which had run into steep losses. Or you can say that I was trying to catch the falling knife. But as the knife continued to fall, I increased the additional purchases (See additional BUY transactions between August 2008 and March 2009).

By December 2008, the valuations had gone into a deep negative territory – a point to point return of (-) 28%, i.e. a steep loss of Rs 12.7 Lacs on a Rs 45 Lacs investment. There was panic all around. And it was like there was no end to bad news – Dubaidefault, Sub Prime Crisis, UPA may not come back to power and no stability after upcoming elections etc.

By March 2009, investment showed a point to point return of (-) 28%, a Rs 52.5Lacs investment had become Rs 37.7 Lacs. And Nifty PE ratio had touched a once-in-a-lifetime low of PE 12.

The crash in the period of August 2008 to March 2009 made me read several prominent articles, blogs and most importantly, Benjamin Graham’s Intelligent Investor. Frankly, it was only then that I started understanding market valuations and the importance of asset allocation. It was here that I decided to consolidate all my investments to evaluate my asset allocation…and to bring it down to a comfortable equity and debt level.

For the first time in my life, I evaluated my complete portfolio of Fixed Deposits, Debt Funds, Equity Funds and individual stocks as one entity.

And based on my readings, I set the following rules for myself:

Rule 1: Save as much money as possible for the purpose of investing.

Rule 2: Before investing (every time), look at your asset allocation and in general, market’s PE valuations.

Rule 3: Continue investing via SIP as per the original plan. Do not stop SIP midway for any reason till target investment value (not the target corpus value) is reached. If need be, pause mutual fund SIP first.

Rule 4: Broadly keep the asset allocation between 60% – 80% in favour of equity – for PE Ratio range of 18-24. And continue investing in SIPs as per investment plan.

Rule 5: If markets fall below 18PE, increase SIPs.

Rule 6: If markets fall further below 16PE, increase buyout, and

Rule 7: If markets fall below 14PE, invest the maximum amount in equity in lumpsum.

Rule 8: If market crosses above 23PE, restrict investment amount in Equity.

Rule 9: Above 25PE, reset equity allocation to something in between 65% – 75%,

Rule 10: Above 27PE, do not invest further and reset the asset allocation to below 65%

Important Note: Equity allocation includes mutual funds and direct stock investments.

In my case, I didn’t sell any of the fund holdings till December 2014. But I did sell my direct equity holdings and invested additional money in debt portion (including gold) to manage my asset allocation.

It is very important to decide the investment period of the money being invested. If you don’t require the money for the next 10 years, then it must go to equity mutual funds only (preferably via STP transfer from liquid funds). But if investment period is for less than 3 years, then it should be invested in debt.

Money required for other periods, i.e. between 3 and 10 years can be shuffled between equity and debt as per asset allocation.

Suggested Reading: SIP is not perfect but it’s your best bet.

So let’s go back to my story…

By May 2009, the election results were out and UPA 2 was forming the government. Markets took the news positively and the portfolio turned neutral i.e. 0% returns after 3 years of accelerated SIP investment. And within a month, i.e. by June 2009, it turned positive.

By this time, I went through a lot of dilemma about whether what I was doing was correct or not. Honestly speaking, at times my portfolio looked scary to me and even disturbed my sleep. Almost all my friends were investing in real estate using cash and loans and enjoying rents & capital appreciation. As for me, I had almost ZERO returns to show after 3 years of investing. Even my family was not sure whether what I was doing was the right thing to do or not. After all I was going so aggressively with fund based investing, without any regard for what others were doing, i.e. investing in real estate.

And apart from the pain of 0% return of MF portfolio, there was added pain of direct stock portfolio being deep in red. This put further pressure on me. My thought process here was that after so many years of negative returns, even after investing in SIP mode and market touching all-time low valuation levels, there is bound to be a point, where I will get decent returns. And backed by this thought and my understanding gained from reading various investment books, I decided to increase my SIP investment – but only using the money which would not be needed for the next 10 years.

In any case, my original plan was to invest Rs 60,000 every month for 20 years to achieve my goals. This would amount to Rs 1.44 Crores (Rs 60,000 per month x 12 months x 20 years). By increasing my SIP now, I was only putting the money ahead of its planned schedule.

By Jan 2010, the market PE valuations touched 23. I brought down the equity asset allocation to 63% (see table) as the market at that point was nearly 100% up from March 2009 valuations.

As I had anticipated, markets did correct but recovered immediately. Throughout 2010, the market PE stayed above 21 and therefore I continued with my regular SIPs.

In October 2010, the market once again peaked out at 25PE. Yet, I continued with regular SIP and adjusted the asset allocation by investing equally in debt and also by selling the direct stocks. I had started looking at my whole portfolio in its entirety. So the bad quality stocks, which I held were sold….even if it meant that I had to sell them at a loss (for the sake of asset allocation).

Although, the market PE remained at 20+ till July 2011, the index itself corrected from 6200 to 5000 by September 2011. Witnessing this correction, I increased the additional purchases in this period and equity allocation touched almost 80% plus. Another reason for increasing the allocation was the availability of cheap USD-denominated loans in 2011 to invest in mutual funds. As of today, it seems to have turned out to be very successful. The loans were paid off in 3 years from salary and the investment amount has nearly doubled.

As 2012 came, the valuations started moderating and PE came down to average levels of around 18 (probably this was due to lots of negative news about government, fiscal deficit, currency collapse, gold restrictions, high oil prices, etc). By this time, I had already become familiar with the volatility and bad news. Here, I decided to keep adding to my MF folio with an investment target of Rs 1.44 crores (and not the total end of 20-year target of Rs 4 crores). The idea was that once I invest Rs 1.44 Crores, I could always give sufficient time to the markets to achieve my target. And I started increasing the investments whenever the PE came below 18. But I ensured that equity portion in the portfolio did not exceed 85%.

As 2013 came, valuations stayed below 18PE and the gains were getting wiped off once again. I was consciously raising the investments in MF and also allocating sufficient funds in the debt side. By September 2013, the portfolio gains were nearly wiped off (just a point to point return of 28% was left out with just Rs 42 Lacs profit on a Rs 1.4 crore investment). It seemed that even after investing aggressively for 8+ years, there was no fruitful result. But this time, I got even bolder than ever and decided that even if markets were to correct 20% from here, the PE would only fall 20% from lows of 16 at that time. So downside was almost limited and upside was not. So I decided to continue doing my monthly SIP from thereon.

Fortunately, BJP started winning state elections and the sentiment started to change from November 2013 onwards. And rising markets have started helping my portfolio too. By this time, my targeted investment of Rs 1.44 Crore has already been done. Yet I am continuing my minimum SIP investment of Rs 60K. From December 2013 onwards, the additional amounts were invested in the debt folio to increase the debt allocation and thereby bring down the equity allocation from 70% to 58%.

As of Dec 2014, the fund has reached a target of Rs 3.92 Crores versus the original target of Rs 4 crores. I still have another 6 years left to take this corpus out. Therefore except in case of nifty valuations going haywire, I don’t intend to take my profits out anytime soon. I expect this amount to become at least Rs 7-8 Crore by 2021 and serve my goals. Although my original goal was 4 crore, with an increase in monthly expenses (retirement corpus), children education and marriage expenses, I may require around Rs 8 Crore. I expect the same to be comfortably met from the current mutual fund folio investment.

As of 1stJan 2015, the returns on mutual fund portfolio stand at 19.80% per annum. A snapshot view from a portfolio management tool is posted below:

The above summarize my investment journey till date.

If you want to have a look at the detailed transaction history over a 10 year period, please click on the image below:

——————–

The second part of the series will cover the learnings which can be used as a bulleted list of guidelines by other mutual fund investors.

Suggested readings:

Hi Abhishek,

One suggestion for porfolio management tool is moneycontrol [dot] com. Here you will be able to create your portfolio across various asset class. I am very satisfied as it updates automatically. As a backup you can always get excel sheet for your portfolio from the website. One drawback I have found is no forex conversion of portfolio, hence everything stays in rupees.

Cheers…

NP

Outstanding post Mr. Ajay, thanks for sharing your valued experience. You have once again proven that investing is a game of mental strength, specially in bear market. Also, almost everyone in our generation lost money in endowment funds but only few got out of them on time.

Hi,

Excellent post. Thanks for taking time and describing your experience in detail.

Can you share one or two good portfolio management tools? Also, while doing an SIP, say every month, does this tool auto add the information based on purchase by the MF. How do we link the two essentially.

Thanks.

indeed guiding post for common investors , more who is starting. one should carefully need to read between the lines. some i like to recall:

1. for life insurance, go only for term plan. no to all other forms

2. for not so knowledgeable common investor , better go through good equity mf route , rather than adventuring direct equity, at least for the core goals of finance life.

3. invest only in a few no. of good equity funds. he seems selected only hdfc equity.

4. never en cash when market is passing through rough patch.

and many more——

Real good post. Thanks for sharing.

The part about doubts while going through the crashes is exceptionally valuable. Excellent article by Mr. Ajay… What makes it even more laudable is that he has very transparently shared all the common mistakes made by him before becoming a more focused, sensible, patient and Intelligent Investor!

Hats off!

Hi, could you please let us know which portfolio management tool was used to compile the data. Thanks!!

Use the one at http://www.valueresearchonline.com/

That has served me well.

Hi,

I am using valueresearchonline portfolio manager and the table is a simple excel sheet wherein the value of porfolio and asset allocation is tracked on monthly basis.

Ajay

Thanks Mr. Bharat.

Thanks Mr. Jigar.

Hi,

I am using valueresearchonline. Entry is manual. It is a very basic tool and it's free.

For auto entry based on transactions, you can use PersonalFN but it is paid service also you need to invest through them. There are many other portfolio managers available as well which can do auto entry but most of them are paid services and/or need to transact through them.

Why to pay, if it can be tracked using a simple tool by just entering the data manually using a basic tool.

Regards

Ajay

Hey! Are you the author of this article. If so I would like to talk to you over phone. I am a journalism student and i am writing an article on SIP.

Thanks Mr. Prachi. Yes, endowment funds sucks ones ability to invest and compound the money.

Thanks Mr. Bharat.

For the purpose of simplicity, I had presented it as invested in HDFC Equity alone. My portfolio had around 8 funds different catagories (mainly due to the large sum that was being invested). Out of the 8 funds some 3 funds are like core funds where in the larger proportion of money was invested.

Hi,

How many years you took to create this corpus? total how much invested and how much is the profit?

I have a few questions if you feel comfortable, please answer:

1. Was the entire corpus invested in the same fund. If not, how many funds you had invested in.

2. How did you track the performances? (In excel sheet or any particular tool)

3. Did you stick with the same funds through the tenure or changed funds in between.

4. 19% CAGR is really good…Personally I haven't been able to achieve this in since year 2008.

Nice post, indeed!

But I wonder if, as with stocks where the right businesses have to be invested in, the right mutual funds need to be identified to invest in. If so, and given the innumerable funds around, what traits should one look for in a fund before pulling the trigger?

The Nifty PE is at 22.69, P/B ratio is 3.61 and Dividend Yield is 1.23.

So, is this the time for caution?

Do you foresee a market correction?

Please advice.

just my doubt. I have impression that PersonalFN is equitymaster.com and quantum amc affiliated ,and advising on asset allocation for personal finance and mutual fund selection on fee ,but have doubt that they are broker.

Mr, Naren,

For the Nifty PE to come down to a attractive levels, the net earnings of nifty 50 companies (NIFTY EPS) must either go up (and the index remain at the same level) or index correct itself (with earnings remain same or goes lower). Other option could be a time correction, whereby the index stays at same level for a longer period and the EPS slowly moves up over this period (longer time) and the PE comes down.

It is going to be one of the above. No point in worrying about that. At PE of 22.69, it is better to be cautious.

However, I must point out here, that most of the small investors have very negligible allocation to equity, yet they bother about the market correction. You should stick to your minimum monthly equity allocation for your long term goals. Additional funds could be kept in debt options for the better entry points. If the market corrects, you can switch from debt to equity at better entry point and if it doesn't then whatever you have already invested is anyway already up.

Always watch your asset allocation and decide where to invest.

Regards

Dear Mr. Madhu,

As with stocks, identifying right mutual funds is equally very important. However, it is not as diiffcult like picking stocks.

I personally look in to many key attributes of a fund and some are:

1. Compare performance over different years and quarters (especially both in bull and bear period) against peer and relevant index.

2. Quality of Fund House (process oriented fund house) and Fund Manager track record.

3. Type of fund (strict no to sector or thematic) – Diversified equity is the preferred one.

4. Expense ratio.

5. Volatility and risk reward ratio (if you can find this data) compared to peer funds.

For most of the investors who have limited monthly savings, max. 3 funds will be sufficient to invest and with little efforts and with the help of internet one can easily find those funds. If you still need a help, approach a honest financial advisor.

Regards

Ajay Sir By Jan 2008 your cost value was 17 Lakhs and Portfolio value was 30 Lakhs.did you analyse now what would have happened if you would have redeemed investment amount of 17 Lakhs leaving the remaining 13 lakhs alone in the MF and reinvested the 17 Lakhs back when the market bottomed out in July 2008.However no stopping of your SIP's at any time during this Period.Please enlighten

Once an incident has happened, it is easy to look back and ask what if but at that moment, nobody could have predicted the market would crash in such a huge way and that one must redeem all their investments. Markets don’t crash to erase all profits in a single day. The crash happened over a period of 6-8 months. You always get the feeling markets will bounce back and hence you don’t redeem clinging on to that hope. Even in bear phase, markets don’t move down in a linear fashion everyday. There will be many days when markets move up giving you hope of a turnaround. The overall outlook of the market is very difficult to predict or determine as it’s happening. The gurujis and experts will make all sorts of claims day after day but it’s all eye wash. It is far easier to dissect and analyze once it has all happened.

Hi Madascene

Agree with you that its impossible to predict anything, atleast in stock markets. But unless we analyze the pasts, we will not get pointers to control our future behaviour in markets. Isn’t it?

And that is all that matters, i.e. out future behaviour in markets. We in any case do nothing about what has happened in past.

Hello Ajay,

Thanks for the detailed reply.

So, what are the debt options where we can park our money?

Gold and FD are illiquid.

I want to know about the debt options, where I can take out the money immediately whenever needed?

So, can you please throw some light on this and how to manage this?

Thanks and Regards,

Narendra

FD is as liquid as it gets, even more liquid than liquid funds dare I say. It takes 5 secs to break an online FD and have the money in your savings account. Of course there is penalty in interest but you wouldn’t be breaking it if you did not face an emergency and people don’t face emergencies every year.

Thank you sir.

I always refer this table that you have provided.

Thanks and Regards,

Narendra

Thanks, Ajay!

Thanks NP

Thank you Mr Ajay. So good to see your reply coming and answering all the questions.

Keep up the good work of sharing.

Dear Mr Ajay,

Thanks for sharing valuable information. One question , Have you already switched to “direct mode ” of MF investing?

Regards,

Venkatesh

Dear Mr. Ramesh,

Yes, as soon as the direct plans were launched, new investements went only in direct mode. Also, as soon as the units became tax free and free from exit loads, I switched them in to direct mode.

Now all my funds are in direct mode only.

Regards

Ajay

Dear Mr. Arun,

It is quite simple, If I could have simply exited at Jan 2008 and reinvested the profit exactly at the bottom in March 2009 (not July 2008), the returns would have been obviously higher.

This post is not about calculating those bottoms and highs and the values.

Regards

Ajay

Dear Mr. Naren,

If you are looking for option to take out the money immediately then it has to be kept with you under your matress (if you have lots) and in your purse (if you have little).. Just for fun.

Liquid funds are the only option available to get you money back in T + 1 days.

Regards

Dear Mr. Bharat,

They are not share brokers. But you have option to transact through them for your mutual fund. There is now a separate fees for financial planning. However, I recommend that you go for Direct Mode (this will boost your returns over a 20Year period significantly).

If you are a beginner, just start with the habit of investing in 1 or 2 funds regularly and get a feel of it. No need for financial advisor to get in to the habit of regular savings. Just go by Direct Mode and invest yourself.

Once you accumulate some decent corpus and if you feel that you need assistance, you can take a call on approaching a financial advisor.

The key is saving and investing the maximum regularly. It is not about the target. Target is just to know that you need to reach some destination.

Regards

thank you for your detailed reply. though i am not novice. i am eagerly waiting for your second post.

'ImportantNote: Equity allocation includes mutual funds and direct stock investments.'

just for sake of discussion. some diversified equity mutual funds are famous (or , rather inclined) to hold large cash for long time at a slightest sign of overvaluation of market , some like QLTE holds more than 30% of AUM in cash/debt equivalent. what do you think how to consider non equity allocation(debt,cash, gold etc) , whether to take into account the portion of cash/debt held in such equity fund in non equity part of our asset allocation, or to consider the entire funds held in such fund as equity part? as the no. of equity funds are not more than 3-4, sizable wealth is in such equity fund.

If you are using VR portfolio manager and its asset analysis, it will show this cash as debt component and you can take a call based on it.

QLTE is taking cash call based on market and individual stock valuations. Assuming you are investing only in this fund then your asset allocation will be automatically adjusted to 70 Equity:30 Debt due to cash allocation, in this case you don't have to do any further adjustment, i.e. only if you are okay with is 70:30 ratio. If you still require it need be brought down say to 50:50, you may have to sell some units and buy liquid funds. Also, this adjustment need not be done on weekly or monthly basis, it could be an annual excercise and /or when you feel that unwarranted optimism and high valuation is given to the over all market (say a PE of 28).

Most of the equity funds doesn't take active cash call and therefore you may have to adjust the asset allocation by yourself. However, in case of few funds like QLTEF, they do take cash calls based on market/stock valuation. You can very well consider this cash allocation as part of your debt folio. Only issue here is that this debt allocation is not in your control. QLTEF in the past have been taking cash calls whenever the markets/stocks have gone up in valuations and have managed it sucessfully.

All of the above depends on your “current Total Investment Value” versus your “Investment Target Value”, if you are at the beginning of the curve in your investment cycle, just stick to simple monthly SIP till you reach a middle part of it then bother about allocation. At the current valuation, just stick to your minimum monthly SIP and keep rest in liquid funds, hoping for a better entry points. It means if you have a investment target of say 1crore and you have till now invested say about 5Lacs, no need to worry about allocation just stick to your minimum SIP.

At an early stage of your investment cycle, you should ideally welcome a market crash and pray that the market remain in a bear market for a longer time so that you could invest more at low levels. At an end part of your investment cycle, you need to pray that the market remains in a bull phase or provide higher exit points to meet your goals.

Regards

thank you very much for your detailed explanation.

I can only say this guy amazing amazing and inspirational

I totally agree with you Uday 🙂

Great story. Could you share the excel sheet shared above and the funds you invested in?

But why would one invest only in HDFC equity fund and not other funds as well?

Hi, I don't want to be a cynic. But the returns of the schemes from SIP (as per moneycontrol) from the exact dates you mentioned are 19.37% and even after all the active management you've done when the markets were down, your returns are also around 19%. So how are the returns similar? Yours should have been way higher isn't it? Or am i missing something?

Above 24 PE too, 5 years CAGR is 26%?

Its shown here for simplicity sake by the writer.

In reality, its best to diversify among multiple (but not too many) funds.

Guess I shared some half-baked image instead of the correct one. Here is the correct one Harshit

Thanks for pointing it out

Note – I am also deleting the wrong one to avoid misleading readers.

ajay ur comments are amazig meticulous point blank.who are you

dev u r waiting for crash patiently.i am happy ur inclining towards ondex funds rather than individual stocks which are highy unpredictable even bluechips.

i have a doubt why an index fund like nifty bees is not giving any dividend despite holding large qty of shares but still charging 0.5% as expenses for doing nothing (passively managing)

to get xtra appreciation from investing in index funds one can write OTM calls every month after buying say NIFTY BEES though it has its own disadvantages.kind of covered call strategy.

Dear Ajay

Wanted your gudance if you can advice which all funds you had invested in and what was the basis?

I am currently invested in HDFC Top 200, HDFC Prudence, HDFC Balanced and IDFC Premier Equity A.

Also planning for Franklin India blue chip, HDFC MidCap Oppties Fund and Sundaram Small and Midcap- looking at 20 years. Kindly advice if I am choosing the right MFs.

regards

rohit

Dear Rohit,

Please let me know how much you are intending to invest with your goals and time to achieve the same. I can provide my opinion based on it. Regarding the funds I invest in, there is no point in comparing my risk appetite might be different from yours..

Regards

Hi Ajay

Thanks for your assistance.

My query is as follows:

Needed your suggestion on my current MF portfolio and future plan:

Current MF SIPs- Total Rs 10,000 monthly

1) HDFC Top 200- Rs 2500

2) HDFC Prudence- Rs 2500

3) HDFC Balanced- Rs 2500

4) IDFC Premier Equity A- Rs 2500

Going forward- plan is to invest Rs 25,000 monthly. Investment horizon atleast 20 years- I am 34 now.

a) Are the above MFs ok? HDFC Top 200 has been a laggard- should I continue or stay invested?

b) I understand I am invested in two balanced funds- hdfc prudence and hdfc balanced- should I exit one or continue investing in both? Should I increase my contri?

c) If I look at HDFC Top 200, balanced and prudence- am I right to say that I am overinvested in large caps ( ignoring the debt allocations of balanced funds) and trying to overheadge myself? I am 34 years now

d) I like HDFC stable- already created HDFC Direct account- so easier to open a new SIP through HDFC- am I being foolish by investing only in HDFC AMC? Like putting all my eggs in one basket (….but in different MFs)

e) I am planning to invest additional Rs 15,000 per month in SIPs and I am building a retirement corpus. Would adding more large cap and mid cap fund ( higher %) be good? my plans are as follows:

– HDFC Midcap- Rs 2500- Mid cap

– Sundaram Select Midecap- Rs 2500- Mid cap

– Franklin bluechip- Rs 2500- Large cap

– Any others (including increasing SIPs in exisiting MFs….would like to add varied and MFs which divrsify my porotfolio and gives aggressive returns….)- Rs 7,500

– For debt- I am looking at PPF + NRE fixed deposits 1-2 years (both tax free)- should I consider liquid/ short term debt mfs?

After this, I will be investing:

Large cap: Rs 5,000

Balanced Funds: Rs 5,000

Mid Cap: Rs 7,500

Others: Rs 7,500

Looking for your kind reply

Regards

Rohit

Hi,

For a 25000 portfolio, youn can go with 4 or 5 funds… For 20 year horizon..

quantum long term, hdfc prudence, Franklin prima plus, hdfc equity.. Equal allocation is ok.

All these funds are multi cap fund with large cap bias. So far they have done well. You need to monitor its performance on yearly basis and switch only if underperforms consistently for 3 years or so.

Dear Rohit,

My opinion to your queries:

a. Your investment is skewed towards HDFC. You need to diversify in to 3 or 4 fund houses. HDFC is a good fund house, but no point in investing all the funds in the fund house. HDFC 200 is a good fund can give better retruns than market over a long term. In my experience, HDFC prudence provides a better return due to mid cap exposure and you can invest in it through SIP to take on volatility.

b. HDFC Balanced or prudence – I prefer prudence but it could be volatile compared to balanced but will compensate over long term. It is also run by a compentent manager.

c. Considering your age (34) and if you are not dependent on the money you are investing and that you are investing for very long term, you should invest mainly in equity funds… Read our post on how to invest surplus money… http://stableinvestor.com/2015/03/Case-Study-Lumpsum-Investment-Stock-Markets.html.

d. You should always diverisfy among funds and fund houses.

e. I recommend large cap + Midcap oriented funds during the initial years till you get familiar with the market. Midcap funds and small cap funds requires some timing to enter and exit. Debt currently, PPF + NRE deposits is a good option. Debt is required for asset allocation purpose only. Don't over invest in debt.

Regards

Dear Ajay

Just want to know if you redeemed some of your units. I would like to understand the capital gains tax you may have paid/ calculated. My understanding of LTCG in SIP mutual funds is that only the final year SIPs amount would be taxed at 15% short term cap tax, and all other SIPs are exempt of any tax (even not added as an income to calculate overall tax while filing taxes to GOI- please confirm).

Is there a possibility that when I redeem after 15 years- I have an option to choose only last 14 years SIP units and not the latest 1 year unit (i.e on FIFO basis).

Would be very helpful to hear from you and others on this

regards

rohit

Dear Mr. Rocky,

FIFO is followed for taxation. Currently any units exceeding 365 days is tax free. You are free to redeem any number of units in an equity mutual fund. If its tax saving fund a 3 year lockin based in FIFO is applicable. Some fund house may have minimum value for redemeption (like say 1000 or 5000Rs.). There is not LTCG on equity mutual fund if your holding period is more than 1 year. STCG is taxed at 15% currently.

Hope this clarifies.

Regards

Ajay

Thanks. So I understand that in an SIP- if I do 15 years SIP and redeem at the end of 15th year- the first 14 years SIP units redemption wont be taxed and the 15th year SIP units redemption will be taxed- but when you are redeeming dpo we get an option of FIFO? Or is it automatic? Or I have the option of managing this during tax filling?

Regards

Rohit

Hi Ajay

If we take Rs 1.6 crore of investment and spread over 10 years (2005-2015) monthly- then per month investment would be around Rs 1.32 lakhs. If we take final exit of Rs 3.8 cr in 01/01/2015 and do an XIRR over 01/ 01/ 2005 to 01/01/2015 then the XIRR gives only 16.5% return. Which is a more reasonable figure considering time value of money- XIRR or Annualised return (as in above)?

regards

rohit

FIFO is automatic (and madatory) and it is not optional.

Hi Dev, Very nice post. I have started taking some steps in investment. I had some misconceptions about saving and investing which are cleared recently.

I intend to do a lumpsum investment in Mutual Fund, current PE level are around 22-23 (Sensex, Nifty)

Would it be a wrong timing. Should I go for some other investment.

Would highly appreciate your reply.

Sadly, there is no one correct answer here.

If you intend to hold your investment for long time, then lumpsum is fine. But then, you also need to think about how big this lumpsum is (when compared to your current portfolio size and income)

For short term, equity is not the right place – unless you can time it well. 🙂

Thanks for sharing excellent article here, i’m planning to do investment of 25,000 in SIP Mode and i have selected some funds, can you suggest me my thought process is fine.

FUNDS SELECTED

1) ICICI Prudential value Discovery fund: 5000/SIP and 25 years of investment

2) Franklin India High growth Companies fund: 5000/SIP and 25 years of investment

3) Franklin india prima plus: 5000/SIP and 25 years of investment

4) Franklin india prima fund: 5000/SIP and 15 years of investment

5) Franklin india smaller companies fund: 5000/SIP and 5 years of investment

sir, honestly i’m very new to mutual fund, can you suggest me my thought process is correct and above funds will working for long term years as i mentioned,

highly appreciate your reply, thanks in advance

What is current value of portfolio? and consider sinario if u would have chosen to invest 4cr in real estate starting from 2007 I guess u would have 3 to 5 flats in metro, just case study to show conventional thinking people that what are the differences in returns .

In one case u would have 3 to 5 flats in metro for 4 cr investment (plus rental incomes and flat value appreciated value of say 12% per annum)and in other case u have portfolio in MF of 6 to 7 cr with 19% returns

Hi!

In order to look at the PE ratio, should I look at Nifty 50 or 100? Let me know. Thanks!

Looked late seems, however greatest single article and guide for MF investment approach i came across till now. Thank you very much Sir.

Dear Ajay or Dev,

I have currently invested in Mid cap Funds. Could you please tell me how to check PE ratio of Mid cap funds. I hope we should not look at Nifty PE ratio for Mid and Small cap funds.

Could you please confirm.

Thanks,

Arun Vijayaraj

Great write up, But its really a tough way to achieve same thing which one can achieve via simplicity

A simple investment of 60K in an index ETF (junior bees) from 1-jan 2004 till 14 sep 2018 would have given a return of 3.81 cr, irrespective of the index PE or any other timing calls.

First of all, really great post! Especially for beginners, who can understand how to keep mindset from ups and downs of the market. Ajay, your journey and learnings has been great. Thanks for such a detailed blog post.

Ajay, it would be nice if you provide better image of transactions provided at the end of post. This will helps me to study your investments and learn more from it. Possible to share any link of CSV or image anyhow?

hi Ajay

this is such a great article

1- can you make a part 3 and show what investments have you done after 2015- 2020

as markets have corrected a lot

2-about PE levels once it nifty 50 PE goes above 27-28 what exactly do you do, stop all sip and move same amount into debt or liquid funds

3-later you keep monitoring PE and once it goes below 20 you move money from debt funds to mutual

kinldy guide on above steps

Sure would be interesting to learn how this portfolio performed in the crash during corona and the bull run subsequently and what were the learnings thought this down and up market journey and where the portfolio stands today.