After procrastinating for months, I am finally sharing names of companies which are part of Dead Monk’s Portfolio (DMP).

But before that, here is a gentle reminder of what to expect from this portfolio.

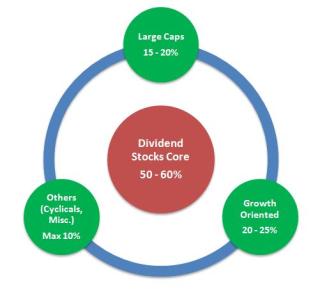

In previous post discussing (or rather rethinking) Portfolio Structure & Composition, I mentioned that for DMP, I would stick with Core Satellite structure and a maximum of 15 stocks in the portfolio. You can read more about the reasoning here.

|

| Structure of Dead Monk’s Portfolio |

In a follow-up post deliberating the need to find more dividend paying companies & stocks from other sectors, I mentioned that most of the stock in existing DMP pay decent dividends. But just to be on a safer side, I would also keep an eye for new dividend candidates, in case I decide to kick out some of the existing stocks. There is good bad news and bad news on this front. I have removed one dividend payer – Graphite India from the core. And next bad news is that I have not found a suitable replacement for this company. 🙁 Hopefully, I would find it soon enough.

Another point to note here is that no. of stocks in DMP has been reduced from 15 to 9. This is because of one above mentioned removal, as well few more removals from satellite part of the portfolio. I have also not named specific companies in Misc (Satellite) part of the portfolio. This part deals specifically with short term and speculative bets and is more dynamic (changing) than rest of the portfolio.

Out of the 9 stocks, 7 were part of original portfolio too. Two new entrants are marked with a ‘*’.

So here are the 9 stocks –

ONGC

Clariant Chemicals

Balmer Lawrie & Co.

Tata Investment Corporation

Axis Bank

ITC *

Yes Bank

IDFC *

Cairn India

|

| 9 Stocks in Dead Monk’s Portfolio |

I would have personally loved to add more stocks in this list to achieve higher diversification. For record, only 4 sectors namely Energy, Chemicals, Financials & FMCG are part of this portfolio. You can say that this kind of diversification may not be sufficient. But this portfolio is in line with my own risk appetite and understanding of certain sectors. I would prefer to stick with only a few companies and business which I understand rather than venturing out dangerously in areas I don’t understand. I may be missing out on potential multibaggers here. But that is a price which I am ready to pay to have a stable, ever growing portfolio of stocks which I am ready to hold for decades and not just years.

Note – You might say that this portfolio is not stable at all. It has been reworked in less than 2 years itself. Correct. It’s true that I have taken the liberty to change (reduce) the no. of stocks in the portfolio. But this is because I myself am learning newer things about myself and my personal investment psychology. I am arranging a long term portfolio around my personality rather than it being the other way round. Anyways, most of these 9 stocks were already a part of the original portfolio. So change is there, but it’s not an earth shattering one. 🙂

I have already covered about most of these companies in detail as provided in a list below.

One particular business which has seen some drastic changes in last few months is Clariant Chemicals. I am personally not very sure as to how to take a call on this one. But because of management’s proven track record and respectable dividend policy, I have decided to stick with the company for time being. But you can take a call yourself by reading my thoughts on Clariant Chemicals and also weighing the consequences of some recent developments (link).

As far as ITC is concerned, please be aware that this is a business which I like, but maybe not at current valuations. So one can wait for valuations to come down. Or if one is investing for years to come, a steady and disciplined buying of ITC’s share can be considered.

I would leave you with these thoughts and this ‘link-heavy’ post. Rest assured that I have put most of my money where my mouth is. 😉 Do share your views about these nine companies and also share your list of stocks which you would be buying for next few decades.

______

Holding from this list otherthan, ONGC,Axis, ITC and Cairn, May exit clariant 🙁

Mid cap PSU banks are available at attractive valuations.

Correct. But I would rather put them in Misc. part of the portfolio for the time being. But yes, mid cap PSU space, is indeed looking delicious to say the least 🙂

Same here. Clariant is a little questionable at this moment. But I will wait for some more time before taking a call. And frankly speaking, the call would depend a lot more on the type of operational results Clariant produces (after the sale of 3 biz) rather than just management and dividend policies

What is the reason behind removing Graphite India? Promoters are already increasing their stake everyday. Good dividend paying company. Proxy to steel sector but relatively safe as it is a consumable with high entry barrier and capital intensive. Dividend stocks should be the stocks with these characteristics. Graphite perfectly fits the bill.Rather Clariant would be a better choice to be thrown out 🙂

As kiran said, Alahabad bank, Andhra bank, Corp. bank etc; are good dividend payers, not sure are they candidates for holding for decades,… Did you track SJVN for this matter? and yes you need tell us the reason why you removed Graphite India,…

True. Even I like mid cap PSU banks at current levels. Some of them are available at valuations which are pretty absurd. But there are a few grey areas like asset qualities of these banks. These may be available at very low Price to Book Multiples; but question is that how much of that ‘book’ is

worth considering at all? Nevertheless, if I had to take a personal exposure to these stocks, they would definitely go to the Misc category of my portfolio.

But I’ll be honest and confess that mid-cap PSB space does

like quite inviting 🙂

SJVNL was on the radar for a while, but eventually decided

not to include it in current DMP. May relook at the stock in future.

Graphite is indeed a decent stock. And Clariant for some may

not be a good stock to hold considering their own set of principles and risk

appetites. But removal of Graphite from DMP does not mean that it is not a good

stock to hold. It is just that too many small caps in core seem detrimental to

a portfolio structure which I envisage for DMP.

I am following your blog from last few months, you have included Balmer Lawrie and Company , it is good dividend paying Co. are you also following Balmer Lawrie Investment. it is available at very reasonable price and paying good dividend.

Can i have your views on Amtek india , Amtek Auto and Redington India. As Permotor share is increasing very fast in Amtek india and amtek auto.

Balmer Lawrie 'Investment' Ltd. can also be a good option for those ready to invest in this 'dull' business indirectly. But one major issue with this company would be its atrociously low volumes of shares being traded.

I track very few cos. and Amtek and Redington are not one of them 🙁

I see that you have ONGC in there, why not OIL instead. It offers excellent dividend yield and in my view better growth prospects too. I think of it as a substitute for both ONGC and Cairn combined. What are your views on this? Along similar lines, I have been looking into Bajaj Holdings and any reason why you have picked Tata Investment over this? Is it because of patronage or the basket of companies held by each.

I have elaborated the reason for choosing Tata Investments in a post which can be found at http://stableinvestor.com/2013/09/tata-investments-available-at-50.html

And it is indeed a combination of both patronage as well as companies invested in.

OIL is ofcourse a good stock to hold. But choice of holding ONGC + Cairn is born out of a thought that holding these two stocks together would provide stability & dividend (ONGC) as well as growth opportunities (Cairn).

ONGC also has a potential ace up its sleeve – OVL. But past records show that OVL hasn't lived upto its expectations when looking at its investments like Imperial Energy etc. Though one should not speculate, but OVL may surprise us positively some day.

So all three stocks have their own merits and demerits.

Hi,

I have been reading your blog for a few months now. It is a good website for investors to get some idea and learn things before investing in stocks. I have been tracking Bosch and TCS. What is your take on this ?

Thanks,

Vijay

Thanks for the compliment KJ

Haven't been tracking TCS or Bosch but preliminary thoughts are that both these are companies with good brands and management which is of repute (though not sure about Boshch's Indian management). A futher analysis would be required to decide anything.

HI Dev,

I am a diligent follower of your blog and I just like your idea of Keeping it Simple,

when it comes to picking up stocks, investing/accumulating wealth.

I have been tracking stocks like Balmer&Lawrie, Tata Investment corp – core dividend payers to be precise for quite sometime now.. Owing to the overall market conditions prevalent currently, is this a right time to start accumulating some of these names ?

or will it be prudent to wait and watch for some time ? may be election results in 2014 ?

Kindly share your thoughts and please keep up the good work

Thanks a lot for your kind words Prasad.

For Balmer Lawrie, the price does seem tempting for long term investors and those looking for yields. But recent announcement by govt asking its own departments to avoid booking tickets through govt agents like Balmer Lawrie etc has raised some concerns. This agent fee is one of the important if not the largest revenue drivers. But it remains to be seen as to how this would eventually effect company's profitability. Company has also decided to shutdown it loss making tea business and is also looking to buy a ticketing company. This may effectively negate the ill effects of govt's advise. But it remains to be seen and its better to wait for while before taking a position in this stock.

Tata Investment is ofcourse a good stock to keep accumulating for really long term. It provides diversification as well as is a sort of quasi mutual fund of reputed names. Company has also been conservative in its approach, which is in sync with my personal wealth building approach. In its management discussion during AGM, the management mentioned that “they would continue to remain conservative in realizing gains during periods of uncertainty”. This in turn would help company to realize gains from its equity investments in “periods of exuberance.” And this according to me is a sensible way to go ahead.

Hi, I have 2 questions..any particular reason for excluding Pharma sector companies in your portfolio given the kind of growth the sector has seen over the past few years. Secondly your portfolio is overweight on Pvt. Sector financials. Do you think a public sector bank like Bank of Baroda or Dena Bank (which offers an excelllent dividend yield of ~8%) even after their sharp run up can be a suitable replacement in order to diversify your portfolio?

I recently came across your blog and realized that this is a blog I should follow from now on. Please share if there is any reason you didn't choose BHEL in the portfolio at those attractive valuations ?

Thanks for your interest in SI Archana. 🙂

BHEL was initially part of the portfolio in early June 2012. But even though it is available at mouth watering valuations now, it is not on my buying radar because of following reasons:

1) The business is stagnating with stagnant revenues and lower profits.

2) Company is also has a shrinking order book, which puts a question about its ability to sustain the current level of profits.

3) Even with reducing order book, it can be assumed that things might become better in future. But company does not seem to be focusing too much increasing its capacity too. So, it looks like the company is not (too) interested in changing in accordance with times.

4) The entry barriers in the sector seem to have been weakened with cheaper and better products being manufactured outside the home country.

But there may be a point when BHEL would start looking ridiculously cheap. And considering the non-so-bright future and an economy which is yet to pick up pace, BHEL is not on current buy list. But it is of course there on the watchlist. 🙂

Your thoughts?

PS – It is very much possible that I may miss out on a multibagger if my thoughts are wrong. But that is the risk we need to live with.

Hi Vernon

To be frank, I don't understand the pharmaceutical businesses and hence have stayed away from them. And only I am to be blamed for this since my grandfather was a doctor. 🙁

So my ignorance has made me pay the price and I am actually unable to invest in a sector which is safe and known to provide decent returns in long term.

I do like PSU banks and the multiples which they sometimes trade are absolutely ridiculous if one is considering to invest for long term. But the issue of rising bad loans (NPAs) seems to make me a little skeptical. But I also feel that this entire NPA thing might be blown a little out of proportion. Personally, I do have some exposure to PSU banks in my personal portfolio.

Thanks very much Dev for your insights into these companies , that was helpful. The profitability aspect of Balmer owing to the recent restrictions from the Govt. would eventually come across in their next Q results and I hope it eventually dies down a couple of quarters down the line hoping the “economy” as such bounces back 🙂

But as you said, indices are at their all time highs and with PEs of 18+, where the risk reward is slightly out of favor. Will have to play the waiting game !

Whosoever expected better results from BHEL , might be in for bigger shock in future. The fundamentals of this company are on very weak footing. Poor order book position, aging technology getting outdated, and not having products and services for one of the big areas of business, where lakhs of crores of rupees is being invested- Transmission Business in UHV range and High Voltage DC Systems, Smart grids. On top of all this recently there have been spate of failures of critical components used in power systems. Being a leading engineering enterprise leveraging of IT in all aspects of its operation is far from satisfactory resulting in failure to bring down cost of operations .

sales/profit images below

I just hope that wait is over soon. 🙂 And we get to buy at lower levels.

Hey Archana

You have brought forward some really valid points which force me to think about the company once again 🙂

If you are fine with it, then I invite you to do a detailed post on why investors should consider BHEL once again. I would be glad to publish it on Stable Investor. 🙂

Hey

You have brought forward some really valid points which force me to think about the company once again 🙂

If you are fine with it, then I invite you to do a detailed post on why investors should consider BHEL once again. I would be glad to publish it on Stable Investor. 🙂

Good observations J

I think all in all, the comment section is throwing up a good set of points to ponder about BHEL. You might be interested in reading the detailed comments made by Archana below.

I sat down to write up a detailed post and came across the very detailed analysis from Vishal, http://www.safalniveshak.com/stocktalk9-bhel/

I think I will not be able to write anything closer to this !

Another interesting info I saw was

http://www.ge.com/in/products_services/thermal-power/pdf/India-Thermal-Fact-Sheet.pdf

From the document, looks like GE is aggressively targeting the indian power generation sector. This might prove to be a huge competitor for BHEL if they succeed in getting orders from PSUs.

In this post the structure of dead Monk's portfolio was easily

understandable and it helpful in having better equity

management company.

True. The post done by Vishal is quite comprehensive. 🙂

Hey bro been almost 7 months since you stopped updating this section. Have you discontinued updating DMP?

No bro 🙂

I am still in touch with DMP. But haven't been able to do a post on the same. Thanks for reminding. I will add it to the list of topics to be covered in near future.

Thanks George.

Looking forward to you. Big props to you and the team behind this site.

Thanks 🙂

But its a one man show till now on Stable Investor.

Cairn India has corrected over 15% from 370 to 315 in the last 1-2 weeks…it seems there are concerns over it's cash utilization. At this time, is it right opportunity to buy these stocks for long term portfolio? Please advise.