During the same period, profits have grown from 180 crores to 1600 crores at rate of 27% plus.

Earnings (per share) have moved up from 1.8 to 10.3 in 2012. In line with EPS, dividends have started increasing in recent past and now (in 2013) stand at Rs 2.6 per share. In last 5 years (barring 2009), company has continuously increased its dividend per share (1.2, 1.2, 1.5, 2.0, 2.3, 2.6).

|

| Earnings & Dividends Per Share (2003-2012) |

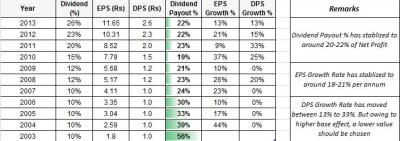

The dividend payout ratio has also stabilized in the band of 20-23%, which is decent considering the high growth rate of company’s business. A detailed comparison between EPS, DPS and their respective growth rates can be found in table below-

|

| Detailed EPS & DPS Data – Growth Rates & Assumptions |

IDFC is a financial institution and hence it makes more sense to analyze company’s Price to Book Value to gauge how over- or undervalued the company is.

Price/Book Value & P/E Ratio Analysis

Company has grown its book value from 16 to 81 in last ten years. That’s a CAGR of more than 20%.

|

| Book Value Per Share (2003-2012) |

We analyzed historical data to check the P/BV multiples at which IDFC has traded. Average P/BV after listing (in 2005) for IDFC stands at close to 2.3. Also it has oscillated in a P/BV range of 1.0 to 5.0. At present, the stock is available at a P/BV of 1.6. That itself points to a 30% undervaluation from historical averages perspective.

If you look at Price to Earnings multiple too, average PE commanded by IDFC is close to 16. The stock currently trades at a PE of less than 11 (TTM). And if you are enterprising enough to consider future earnings, then stock is available at a forward PE of 9.2 (FY 14) & 7.7 (FY 15)! And a PE of 8 is considered apt for a no-growth company. 🙂

|

| P/BV Comparison – Current, Historical Average & Estimated (2014, 2015) |

|

| P/E Ratio Comparison – Current, Historical Average & Estimated (2014. 2015) |

Final Words

The company, though well managed and growing at a decently fast pace, seems to be undervalued. We have not analyzed management, business, etc as this post was more to do with valuations based on simple historical parameters. But being headed by Deepak Parekh and his team, it is assumed that management would be doing a decent job. In case you are interested in understanding more about the business, management and other factors, we suggest a simple Google search. It will throw a plethora of brokerage reports analyzing the same. You can also access company’s latest Annual Report here.

Can we analyse IDFC on the basis of its PE? Financial institutions are assessed differently , correct?

Yes we can. We did touch upon the PE aspect in the post itself. What are your views of IDFC and its PE?

Hi Stable Investor,

I came across your excellent blog 2 hours ago while I was agonizing over my very recent investment in ONGC. You have very good words to say about ONGC. I am however regretting my decision to buy into ONGC as I bought 550 shares at a ridiculously high price of 345, just the day after the gas price hike was announced. I was taken in by the business channels created hype and was made into a fool by the market. Ever since I bought the shares, the price has come down to 296 today. I dont regret buying into ONGC, just that I bought at such a ridiculous price. So I basically want some advise from you as to what I should do with my shares ? Should I hold them for a long term – and I can afford to hold them for a very long term , say 3-5 years. Will it appreciate in price at all ?

I get the impression that because of the huge subsidy burden (which you have not talked about), huge FIIs and DIIs are moving out of ONGC to private sector oil and gas players like Reliance which are not answerable to the government. So, while the NIFTY has appreciated by 300-350 points over the last 14 days, ONGC has declined by 50-55 Rupees from its high. When Nifty does well, ONGC is one of the laggards., When the Nifty does badly, ONGC does worse than others. It is a really tough stock to follow ever since I began tracking it 14 days ago. What do you make of the whole recent ONGC situation ?

Your statement that you don’t regret buying shares of ONGC sums it up pretty well. ONGC is definitely company that can be called as a safe bet for ‘really long term’. And frankly, 5 years ‘should’ not be considered to be very long term. As far as returns from such boring businesses are concerned, one should not look at them purely for capital appreciation. These companies are stable dividend payers. Analysis of ‘Total Returns’ which also includes dividends would be a better metric for this company.

As far as decision about what to do with your investment is concerned, it is more about what exactly is your time horizon and your personal investment personality. If you are ready to wait for long term, it would make sense to buy this stock on bad news rather than good news. In this case, good news was definitely an inviting one. But the execution part of this good news depends on someone who is not known for its nimbleness in decision making.

You second para discusses about FIIs and DIIs, which are looking for returns in short term as they are answerable to their own set of investors. But as individual investors, we are not answerable to anyone except ourselves. So, instead of just buying because of newsflow, its more prudent to select a few good businesses which you understand and then wait to buy them at cheap prices. How long should you wait? It depends on how long you can. But always remember that profit is made at the time of buying and not selling. So, a business like ONGC would continue to create value (business value) irrespective of the fact whether FIIs or DIIs are selling or buying it. So it would make sense to buy it when everyone else is selling it. In your case, or rather what a normal individual investor like us would do is that we would go ahead and buy when everyone else is buying. And that is simply against common sense. You always wait for shopping for your clothes, appliances during sales. Isnt it? So why not wait to buy shares of good companies at distressed prices. But as we already mentioned, this ‘waiting’ part can be treacherous. And it is totally dependent on the type of person you are investor is.

We are not certified experts and hence would not like you to listen to us blindly. So please do you own analysis before taking any decision with your hard earned money.

Thank you Stable Investor for the response…you are absolutely correct. ONGC is a very long term investment. I will hold on to my shares till I reach middle age, or even longer, and earn hefty dividends till then. Markets may have reacted badly because of ONGC's subsidy burden……and you are absolutely correct ONGC should not be bought for capital gains…… I have come to the view that even ONGC's ties to the government is essentially a “good thing”…..why ? Because how the government make money out of ONGC ? By making ONGC issue dividends to it.Government has 69% share, so gets 69% of the dividend money….I too have a 0.000000000001% share and like the government, I too will get my dividend money – which will only increase because, gas price hike means 29% higher PAT, and ONGC routinely issues 30-40% of its earnings as dividends….so as earnings increase, so should dividends………my expectation for my 550 shares is a dividend of Rs.6000-6500…. (last year I would get Rs. 5300) ……which is not bad considering putting the same money in bank FDs will get me Rs 15,000 (accounting for tax). So, in spite of my stupidity in buying at such a high price, all is well – I guess 🙂

Great. 🙂

Idfc has fallen to 80s. Di you guys buy it??

Accumulation phase is on Vishal. The stock has a decent company and a business behind it. It is indeed a good stock to hold for long term. 🙂

Wonderful coverage. One thing to look at is IDFC, whether due to Deepak Parekh's involvement or else, seems to have an approach similar to HDFC. It is building a block of entities under its fold – mutual fund, PE, etc. and all these will have a say on the value of the company. But then, we are talking of say 15 – 20 years here. Look at all the highly priced ones. HDFC Bank came in the later half of 90s and used to trade at Rs.55 per share (Rs.10 face value).

Look at IDFC's market – it is the largest infra player. They can go and invest a Rs.1000 crore in a project without battling an eyelid. So they can pick and choose the best. Look at their NPAs even in these worse times.

Look at the senior management buying shares in IDFC from the market and then the ESOPs – these are other indicators about where the share price will go. Management and employees having good shareholding also pushes up dividends – that is sort of their pension income !

Regards

RR

Thanks RR.

Hopefully, IDFC would have been a good stock pick when we look back after 15-20 years. 🙂

You holding it or accumulating it?

how do you get 10 years book value data?

Annual Reports or numerous sites providing free financial data

Generally we get past 5 years data in websites. Where do we get 10 years data?

As I already said, there are many sites. One such would be Money Control

Hi Stable Investor, What is your stand on IDFC? Not at all participated in Big Rally.